BrisConnections, Traffic Forecasts and ASIC: Preventing Future Fiascos

Posted by Big Gav on April 23, 2009 - 6:30am in The Oil Drum: Australia/New Zealand

This is a guest post by Cameron Leckie of ASPO Australia. The post is a copy of a letter which has been sent to the Australian Investments and Security Commission. The media discussion on the BrisConnections fiasco has not as yet covered the traffic forecast for the project. This will no doubt change as events unfold.

The current situation that has arisen with BrisConnections and the Airport Link project should never have occurred. If the projects proponents and BrisConnection’s had conducted an Oil Vulnerability Assessment, this project, at least in its current form, would never have been commenced. That in turn would have meant that investors did not lose significant amounts of money, or be in the situation where they could lose their homes and/or become bankrupt. There also would have been no requirement for the current round of legal cases.

This letter will explain why Oil Vulnerability Assessments should be mandatory for all transportation and related investments.

BACKGROUND

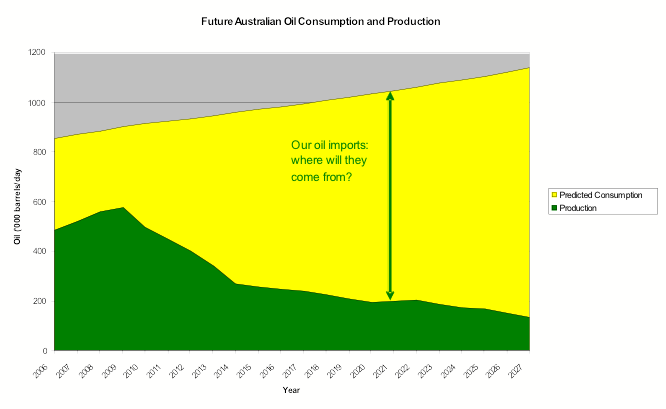

Chart one details ABAREs projection for Australian oil consumption and Geoscience Australia’s predictions of Australian oil production. The chart shows that Australia will become increasingly dependant upon oil imports, reaching a reliance of 85% by 2025.

Chart One: Australia’s projected oil consumption and production. Data sourced from: http://www.ga.gov.au/image_cache/GA11371.pdf

This raises the question of where will this oil come from? Unfortunately it is unlikely that Australia will be able to import the quantity of oil required, due to a number of factors. These include:

Growth in demand for oil, particularly from nations such as China and India.

The majority of the world’s oil producing nations are past their domestic peak in oil production. This includes the majority of OECD nations who are net oil importers and will have an increasing call on oil imports as their domestic production declines.

Many oil exporting nations are past their peak in oil production. Combined with increased domestic consumption, this results in a rapid decline in oil exports.

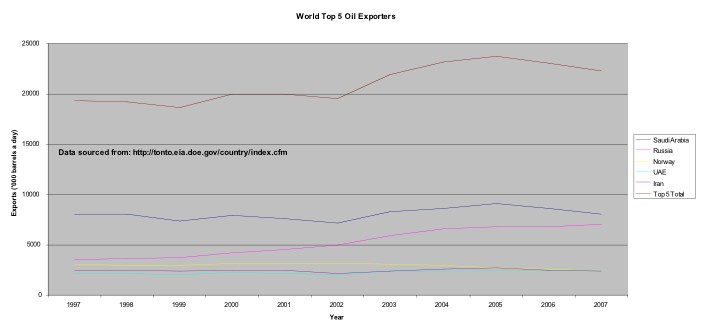

The net result is that the quantity of oil available to export in the future will be declining. Chart two, prepared using data from the US Government’s Energy Information Administration (EIA) shows that oil exports from the world’s top five oil exporters are already in decline, as are the exports from those countries that Australia imports the majority of its oil from (table one).

Chart two: Oil Exports from the World’s Top Five Oil Exporters

|

|

Australian Oil

Imports 2006-07 |

Year of |

Year of Peak Exports |

Decline in Exports |

|

|

Total Decline |

Per annum Decline |

||||

|

Vietnam |

6710 |

2004 |

2001 |

50% |

8% |

|

Malaysia |

3716 |

2004 |

1989 |

39% |

2% |

|

Indonesia |

3391 |

1981 |

1981 |

109% |

4% |

|

United Arab Emirates |

2971 |

? |

2006? |

N/A |

N/A |

|

Papua New Guinea |

2059 |

1993 |

1993 |

84% |

6% |

Table One: Export situation of top five countries that Australia imports oil from. All data sourced from http://tonto.eia.doe.gov/country/index.cfm

Two oil analysts who have been investigating declining oil exports suggest that the average rate of declines in oil exports from the top five oil exporters will be 6.2% +/- 4% per annum. With demand for oil imports growing, this situation will likely result in demand destruction, higher oil prices and physical shortages.

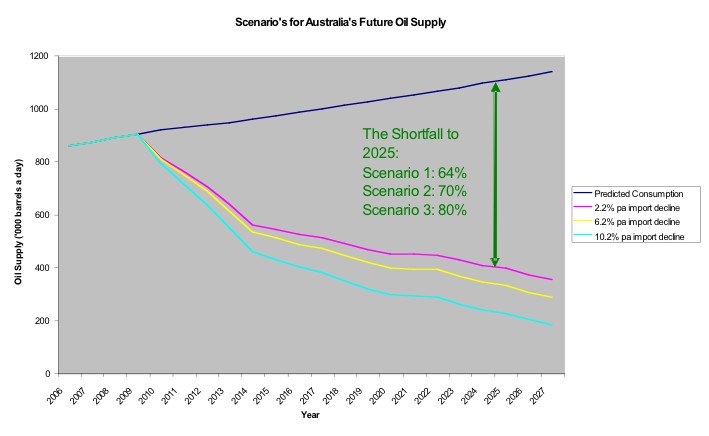

Australia’s oil supply consists of our domestic oil production and oil imports. Combining Geoscience Australia’s prediction for future Australian oil production with imports declining at 6.2% +/- 4% per annum provides three indications of Australia’s future oil supply, as shown in chart three. There are a number of assumptions used in developing this model, they are:

Australia imports limited oil from the world’s top five oil exporters. However large oil producing regions production declines at a slower rate than smaller oil producing regions. Therefore applying the 6.2% +/- 4% pa decline rates is likely to be a more optimistic decline rate than that which will apply to Australia’s major oil providers. This is further supported by the percentage declines in exports from Australia’s major oil providers shown in table one.

That Australia can import its current percentage of the worlds declining oil export base. There is and will continue to be intense competition from all oil importing nations for the declining world oil export base. This includes the majority of OECD nations and rising powers such as China and India. This will be a very difficult task to achieve.

The model does not account for geopolitical factors that could reduce oil available for export. Examples of such factors include civil unrest in oil exporting nations, war, bilateral arrangements, such as those recently signed between Russia and China, and exporters deciding to produce less oil in order to maximise their profits and save oil wealth for future generations, as Saudi Arabia is doing.

Does not include alternative fuels. However according to the Commonwealth Government’s National Energy Security Assessment, these are unlikely to be more than niche fuels out to 2023 (the latest forecast prediction) and therefore are unlikely to make more than a minor contribution to Australia’s fuel supply.

Does not consider the cost of oil. It is expected that the cost of oil will become increasingly volatile and costly, continuing the trend of the last five years. Indeed there has been numerous comments from the International Energy Agency and other organisations warning that the current oil price and reduction in credit as a result of the global financial crisis will result in another oil price spike when demand for oil recovers.

Chart three: Scenario’s for Australia’s future oil supply.

THE IMPACT ON TRANSPORTATION

A shortfall in oil supply of the magnitude suggested in chart three will have significant impacts upon the Australian economy and transportation in particular. Unfortunately, most major transportation projects have paid lip service to or ignored the possibility of declining liquid fuels availability on their traffic demand models. If, as posited, Australia’s oil supplies contract for the foreseeable future, there are a number of likely impacts on transport in Australia. These are:

The price of fuel will increase as supply is less than demand. Higher prices will induce demand destruction to balance supply and demand. Alternatively, the Government may ration the allocation of fuel.

Travel behaviours will change. People will travel less or take other actions such as car pool, walk, cycle or use public transport. This is supported by the Queensland Transport Facts 2008 study which shows that Vehicle Kilometres Travelled have been trending downward since 2004, coinciding with a period of increasing fuel prices.

People will purchase vehicles with higher fuel efficiency or alternative propulsion systems.

The logical conclusion, in fact the only conclusion, from the first two impacts is a reduction in travel demand. The third impact has the potential to increase travel demand. However an analysis of the factors required to increase traffic demand as the oil supplies declines make this scenario appear highly unlikely. For example:

Data collected from the annual ABS Survey of Motor Vehicle Use shows that the average passenger vehicle fuel efficiency of Australian vehicles has remained virtually unchanged since 1963.

97.2% of the Australian vehicle fleet is fuelled by diesel and petrol. Of the remaining 2.8%, the majority are fuelled by LNG, LPG or mixed fuels. Only a very small proportion is electric or hybrid propelled vehicles.

New car sales have fallen significantly as a result of the Global Financial Crisis. According to the Federal Chamber of Automotive Industries new car sales have fallen by 19% in 2009 when compared to 2008.

According to the ABS, the average age of Australia’s vehicle fleet was 9.9 years in 2008. With new car sales falling and likely to continue to do so, this implies that the average age of Australian cars will increase. This will prolong any attempts to increase the Australian vehicle fleet’s average fuel efficiency.

Combining these factors suggests that even if there was a will to significantly increase the fuel efficiency of Australia’s vehicle fleet, this will take a period of decades. Unfortunately Australia does not have 10 or 20 years to increase its vehicle fleets fuel efficiency, as shown in chart three. As a result, it appears highly unlikely that as Australia’s oil supply declines that forecasts of perpetual growth in traffic demand can be met by an increase in vehicle fleet fuel efficiency. In fact a reduction in travel demand is far more likely to occur.

BRISCONNECTIONS: A CASE STUDY

One of the key risks identified in the BrisConnections Airport Link Project Product Disclosure Statement is that of traffic volumes (see section 6.2.1, page 60). The PDS states that:

The impact of a significant and sustained increase in fuel prices on traffic volumes is a risk that should also be considered. Increased fuel prices may lead to a reduction in car ownership, car utilisation and a shift in modal share to public transport, walking, cycling or motorbikes and scooters. (p. 60)

The traffic forecast model for the project was developed by Arup. Arup’s Traffic forecasts for the Airport Link Project (pp 110 – 124 of the PDS) predict that the average increase in traffic volume across the three tollable sections will be 47% from 2012 to 2031. This is in comparison to a potential shortfall in Australia’s oil supply of 64% to 80% by 2025.

The PDS risk chapter refers to the potential impact of fuel prices on traffic volumes six times. However nowhere in Arup’s traffic forecast is there any mention of the impact of fuel prices or fuel availability. This raises the question of why was the impact of the future availability and cost of fuel not mentioned during the traffic forecasting process. For an issue of such vital signifance to the viability of the entire project this appears to be negligent at best and is something that warrants further investigation.

ASIC’s ROLE

In ASIC: a guide to how we work document, it states that ASIC adopts a ‘risk-based approach to regulation.’ Risk is a combination of impact and likelihood. The PDS issued by BrisConnection’s states the impact of higher fuel prices, namely that they will negatively impact upon traffic volumes. However there is no mention of the likelihood of such a risk eventuating. Chart three provides a clear indication that the likelihood of this risk eventuating is highly probable. As a result, there is a high risk that traffic volumes will not be met. This in turn will have a material impact on shareholders. Despite this, nowhere in the PDS does is this mentioned.

Australia’s future oil supply is one area where ‘new risks might emerge,’ new risks being something that ASIC aims to identify. Australia’s future oil supply poses significant risk to many investments, particularly those centred on transportation. ASIC, through its review process of documents such as prospectuses and product disclosure statements, could ensure that investors are fully appraised of the risks associated with Australia’s future oil supply. This should be in the form of an Oil Vulnerability Assessment that includes:

An assessment on the future cost and availability of Australia’s oil supply.

The impact of future fuel costs/availability on the investment and the likelihood of occurrence.

The assumptions on which alternative fuels and/or propulsion methods will address a declining oil supply and enable forecast traffic volumes.

If BrisConnections and/or Arup had of completed an Oil Vulnerability Assessment for the Airport Link Project, it is highly unlikely that the project would have proceeded in its current format. This would have protected the interests of all parties. BrisConnection’s Airport Link project provides a perfect example of why Oil Vulnerability Assessments should be mandatory for all transportation and related investments.

CONCLUSION

In summary, it is highly likely that Australia’s oil supply will contract for the forseeable future. This will invalidate any traffic forecasts that predict perpetual growth in traffic demand without considering Australia’s future oil supply. This is likely to create significant investment risk that is currently being ignored or paid lip service to. For as long as this continues, it is likely that there will be more BrisConnection’s type fiasco’s. ASIC through its regulatory powers has a significant ability, and responsibility, to ensure that those organisations proposing investments based on perpetual growth conduct an Oil Vulnerability Assessment with regards to Australia’s future oil supply and its impact upon transportation. If implemented, this action would ensure that investors are fully appraised of the risks that they are taking and encourage investment in areas such as public transportation. This would be of significant benefit to both investors and the Australian community at large.

The Australian leadership has still not been able to comprehend that the current transport methods have a swiftly approaching use-by date as this article points out.

Not only are we spending precious resources on road megaprojects but doing next to nothing about replacing heavy,long distance road transport by electrified rail.

We are doing nothing about substituting LNG for diesel for those applications where rail is not appropriate.To the contrary,we are busy selling off LNG to overseas buyers.LNG is a finite resource however it would provide some breathing space while we build sustainable transport systems,let alone a sensible and sustainable society.

Virtually nothing is being done about building a national gas pipeline grid.

I won't go off topic by listing even a few of the other areas where precisely zipp all is being done to address glaringly obvious(one would think)potential disasters.

Sleepers Awake! But what does it take?

Well - we do have quite a lot of gas, so exports don';t seem to be a rpoblem for several decades and a national gas grid doesn't really add any value - unlike a national electricity grid.

http://anz.theoildrum.com/node/4094

http://anz.theoildrum.com/node/4618

Yes,Gav, we do have a lot of gas and my guess is that we will be needing every bit of it.

BTW,have you read the last Quarterly Essay - Quarry Vision,by Guy Pearse?

Well - even with further expanded gas exports (and use in transport and power generation) we seem to have well over 50 years of the stuff left - that is time enough to completely switch to renewables.

I haven't seen Pearse's article - what does he say - do you have a URL ?

As far as I know the Quarterly Essay is only available in hard copy.I got mine from McGills in Melbourne for $15.95 but it should be available from any halfway decent bookstore.

Pearse's book,"High and Dry",on Australia's response to climate change,is also worth a read if you have not already done so.

Pearse writes from the perspective of a former industry lobbyist,consultant and spin doctor.He was also a member of the Liberal Party and a speech writer for Robert Hill.

Basicly,the essay and the book explore the "carbon lobby" and it's relationship with both the Liberals and Labor.In principle,what he is saying is not news to me.But when I read the essay earlier in the year I found myself getting increasingly angry,because of the detail he goes into,at the bowl of self serving crap we are being served up by the hierarchy.

Thanks - I'm familiar with Pearse and his greenhouse mafia story - just wondering if the essay had anything new.

I spotted the Quarterly Essay at my local mid last month. There were only two copies of it, so I snagged one on the assumption it wouldn't be there at the end of the month when I'd know if I had any spare cash or not (I don't). Like you, I got angrier with every page I turned.

Hopefully Rudd calls a Double Dissolution election later this year, because the Greens should pick up a swag of votes.

Another very thought-provoking piece Gav, thanks.

I hope that "efficiency" and "renewables" will be the way that Australia plugs the coming oil gap. ...But realistically, that requires insightful Government planning, whereas a few "emergency" Coal-to-Liquid plants can be scrabbled up much faster!

;-)

(Much like the vogue for Desalinated Water plants in every State in recent years, rather than just raising the price of tapwater slightly to induce more efficiency... Thinks: Hey, I hope those Desal plants are being built more than 6 metres above current sea level!)