How Technology Increases Oil Production

Posted by Phil Hart on July 17, 2008 - 10:00am in The Oil Drum: Australia/New Zealand

How can you double something and still have ten times less than you started with?

| The answer to this question will help us reassess claims that advances in oil field technology will postpone the peak in global oil production. The question itself arises from a case study of Enhanced Oil Recovery in the Handil Oil Field in Indonesia. |

The Handil Oil Field

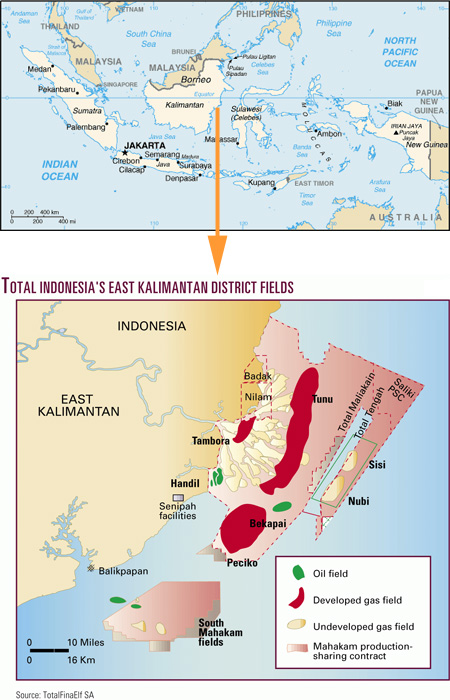

Handil is a giant oil field in the Mahakam Province of Indonesia, discovered in 1974 and still operated by 'TOTAL Exploration and Production Indonesia'. The International Society of Petroleum Engineers had a feature article on 'Reviving the Mature Handil Field' in the January 2008 addition of their Journal of Petroleum Technology [1].

Figure 1: Location of the Handil Oil Field

Source: Wikipedia and LNGplants.com

From the JPT article:

- The Handil field comprises 555 unconnected accumulations (reservoirs) in structurally stacked and compartmentalized deltaic sands.

- The reservoirs are trapped by the Handil anticline, which is cut by major impermeable fault dividing the field into two compartments: north and south.

- The reservoirs are between 200 and 3500 metres subsea and cover an area 10km long by 4km wide.

API and Sulphur from this Handil Crude Oil Assay

Oil Recovery

Before proceeding, it is important to understand the basic mechanisms of recovering oil from a reservoir:

Pressure on the fluids in a reservoir rock causes the fluids to flow through the pores into the well. This energy that produces the oil and gas is called the reservoir drive [2].

Primary Recovery is the oil produced by the original reservoir drive energy. The two most important natural reservoir drive mechanisms are Gas Depletion and Water Drive:

- Gas Depletion Drive: In the subsurface, the oil is under high pressure and has a considerable amount of natural gas dissolved in it. When a well is drilled into the reservoir, pressure in the reservoir decreases and gas can bubble out of the oil which can form a gas cap. Dissolved gas drive is very inefficient and will produce relatively little of the original oil in place from the reservoir. While this drive mechanism is commonly used to produce gas fields, rarely would it be relied upon for oil production.

- Water Drive: Water Drive reservoirs are driven by water adjacent to or below the oil reservoir. The produced oil is replaced in the reservoir by water. An active water drive maintains an almost constant reservoir pressure and oil production through the life of the wells. The amount of water produced from a well sharply increases when the water reaches the well. The recovery of oil in place from a water-drive reservoir is relatively high.

It depends highly on the type of reservoir drive, the viscosity of the oil and permeability of the reservoir, but primary recovery produces on average 30-35% of the oil initially in place (OIIP), although it can be as low as 5%. Generally this leaves a considerable amount of oil in the reservoir, so additional recovery techniques may be employed:

Secondary Recovery: This involves injecting water into the field through injection wells. It can be initiated before or after the natural reservoir drive has been fully depleted. The aim is to use the water to sweep some of the remaining oil to producing wells. A waterflood can recover anything from 5-50% of the remaining oil in place that would not have been produced using primary recovery alone. The actual amount achieved depends enormously on the properties of the particular field.

Tertiary Recovery (Enhanced Oil Recovery): In some cases, where Secondary Recovery still leaves a significant amount of oil in place in the reservoir, enhanced oil recovery may be effective. Enhanced Oil Recovery (EOR) includes thermal, chemical and miscible gas processes - injecting substances into the reservoir that are not naturally found there.

Secondary Recovery techniques have been widely used since the early days of the industry. They are already in place in almost all fields where it is necessary or effective.

The history of Tertiary recovery also goes back more than half a century. Tertiary Recovery, however, is only effective for a narrow selection of fields and involves substantially higher costs and effort.

Lifecycle of a Giant Oil Field

In their 1986 assessment of the world's 500 "Giant Oil and Gas Fields", Carmalt and St John [3] ranked Handil number 303 with an estimated 800 million barrels of ultimately recoverable oil. We can see that this 20 year-old estimate is very close to the mark in terms of the amount of oil produced with primary and secondary recovery (see Table 2). This should give us increased confidence in the Carmalt and St John estimates for other giant fields, including those in Saudi Arabia and other OPEC countries where current data transparency is inadequate.

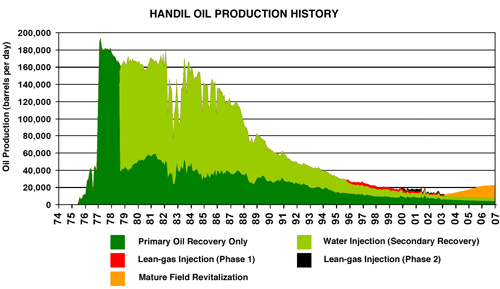

Figure 2: Handil Oil Production History

Adapted from this Presentation: Mature Kutei Basin of Indonesia

JPT: To maintain production and reservoir pressure, water injection was started in 1978 which maintained the 160,000 BOPD production until 1985.

The production profile here presents a common picture of the lifecycle of a giant oil field. Secondary recovery (water injection) is used to maintain an oil production plateau for as long as possible before more significant decline becomes inevitable. After that, owners of the field have to decide whether intensive efforts to study, develop and apply tertiary (enhanced) recovery will recover enough additional oil to make it economically attractive.

Mature Field Revitalization

JPT: In November 1995 a lean gas injection project was initiated in five reservoirs. The project boosted the production of the five large reservoirs and altered the overall decline rate of the field. Therefore, the project was extended in 2000 to six other large reservoirs, which resulted in more than 25 per cent of the field reserves being under a tertiary-recovery mechanism.

Tom Standing (ASPO USA Newsletter, November 5, 2007):

Oil extraction by miscible gas injection goes beyond conventional pressure maintenance by injecting a gas with specific properties, at pressures sufficient to create a highly mobile gas/oil fluid phase that swells and fills pore space in the reservoir rock. Compression energy from the surface pushes this miscible phase toward wellbores. Injected gas cannot be chemically reactive in the reservoir.

Of the 8 million barrels produced using enhanced recovery mechanisms up to 2002, 6 million was from Phase 1 Lean Gas injection and 2 million from Phase 2 Lean Gas injection. Spurred on by their early success with lean gas injection, TOTAL kicked off a bigger campaign of 'Mature Field Revitalization' in 2003, including the following activities:

- Dynamic Modeling and Sweet Spot Mapping: Dynamic computer models combined with well logs and other static historical production data are used to identify the location of bypassed oil and smaller undrained areas of reservoir.

- Light Workovers (LWOs): Well interventions performed without pulling the completion at the bottom of the well. These LWOs are used to isolate water producing zones and target prospective new reservoir sections.

- Infill Wells: Where a Light Workover cannot be used because of the condition of the well, drilling new wells recovers the potential reserves in areas identified by Sweet Spot Mapping.

- Enhanced Oil (Tertiary) Recovery and Optimization: Miscible Gas Injection (described above), in this case using natural gas, is injected into the crest of the reservoir and attempts to sweep oil that has been bypassed toward the producing wells.

JPT: In 2005, 26 LWOs were performed, of which 19 were successful. The project resulted in 1.7 million STBO (stock tank barrels of oil) production during the year and 4 million STBO of incremental reserves. The total cost was approximately USD 2 million.

The stated costs for LWOs yield a figure of $2 per barrel added as reserves - very economical but the potential is of course very limited (production costs are in addition to this). The more expensive infill wells were used for shallow reservoirs with heavy oil, or multi-lateral wells to target multiple small reservoirs which did not justify single wells previously.

The Results

Hopefully it is clear that what is simply described as 'Mature Field Revitalization' comprises many years of technically challenging study and modeling followed by intensive application in the field. For the engineers and geologists involved this was no doubt rewarding work. While all of these activities can be considered the application of 'new technology', only the final step is considered Enhanced Oil Recovery.

JPT: These key elements increased the production from 12,500 BOPD in 2003 to 23,000 BOPD in 2007.

For a substantial investment of time, money and effort in the giant Handil oil field, we gain just 10,000 barrels per day of oil production. Yet this case study has appeared in the Journal of Production Technology because it is a prime example of what can be achieved (the two other case studies in the same issue showed only very mediocre gains). While there will be isolated fields that perform better, there will be many more that fail to make the pages of the Journal of Petroleum Technology because they provide far less spectacular returns. In many cases, after intensive appraisal and assessment the schemes never get off the drawing board.

Tom Standing (ASPO USA Newsletter, October 1 2007):

An aspect of EOR that is seldom discussed is that recovery processes target oil fields with highly specific properties of reservoir rock and fluids. In brief, EOR processes are not universally applicable. With long years of research and field trials, the industry has developed two categories of EOR success.

- Thermal methods in highly permeable reservoirs containing heavy viscous oil

- Carbon dioxide or nitrogen (or natural gas) injection at miscible pressures in reservoirs with poor permeability

The vast population of oil fields with light oil and good permeability generally have not responded to EOR efforts [because Secondary Recovery alone is already highly effective].

The Impact of Technology

TOTAL would be pleased if their efforts with the Handil oil field can increase the ultimate amount of oil recovered by even 5% (40 million barrels) compared to primary and secondary recovery alone. A 10% increase in this case looks unlikely. The returns look pretty small when averaged across the world's oil fields, given that only a proportion of them deliver a reward for this kind of effort.

While these aspects of 'advanced oil field technology' can increase production from particular oil fields, thereby attractively increasing profits for the owner, they do not significantly alter the picture of global oil resources.

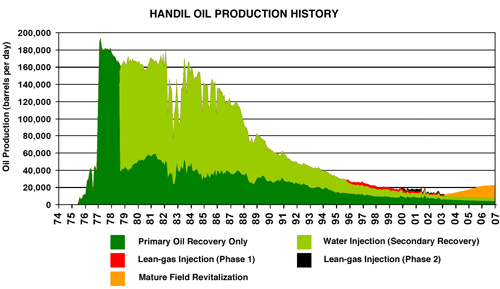

Figure 3: World Oil Discovery and Production

The Law of Diminishing Returns

Economists seem to have trouble understanding geological and technical limits to oil production, but they should understand the law of diminishing returns (Wikipedia):

According to this relationship, in a production system with fixed and variable inputs, beyond some point, each additional unit of variable input yields less and less additional output. Conversely, producing one more unit of output costs more and more in variable inputs.

In our case we have finite, bounded oil fields. Until the mid 1980s, discovery of new oil fields exceeded our consumption rate, so there was little need to increase recovery from existing fields. As the discovery rate declined, companies had greater motivation to extract more from their existing fields. While at first they found easy gains, in the last decade especially the amount of effort required has climbed and yet the returns are falling: is it any surprise that oil industry inflation is rampant?

Oil field reserves may have 'grown' 10-20 per cent since the Carmalt and St John assessment in 1986, but we should not expect the next 20 years to deliver the same gain. Discovery of new fields has tapered off to low levels and the easy pickings for increased recovery have already been had. Unconventional oil sources will yield similarly small returns for extraordinary amounts of effort. The numbers simply do not stack up for oil production continuing to expand for another decade against the decline in large mature conventional oil fields.

Summary

How can you double something and still have ten times less than you started with?

In the case of the Handil Oil Field, a concerted campaign to revitalize the field almost doubled production from 12,500 barrels per day in 2003 to 23,000 in 2007. Yet this field had once produced nearly two hundred thousand barrels per day.

This is a representative picture of the role of technology and enhanced oil recovery: merely extending the tail end of production in oil fields that are well past their own peak in production.

So while the Society of Petroleum Engineers and other optimists tell us that technology and enhanced oil recovery will delay peak oil, a more objective look at the data suggests that production declines are relentless and they are stacking up much faster than incremental technological gains.

Contact the Author or download this article as a PDF.

Try these tags for other relevant articles at The Oil Drum:

Enhanced Oil Recovery

Technology

and don't forget HO's wonderful Tech Talk series, which has just about every resource production and extraction topic one can think of.

References:

[1] Denney, D. "Reviving the Mature Handil Field: From Integrated Reservoir Study to Field Application", Journal of Petroleum Technology, Society of Petroleum Engineers, Houston, January 2008.

[2] Hyne, Norman J., "Nontechnical Guide to Petroleum Geology, Exploration, Drilling, and Production". PennWell Corporation, Tulsa, Oklahoma, 2001.

[3] Carmalt, S. W., and St. John, B. "Giant oil and gas fields," in M.T. Halbouty, ed., Future petroleum Provinces of the World, Memoir, 40, AAPG, Tulsa, Oklahoma, 1986.

[4] Mature Kutei Basin of Indonesia: http://www.ccop.or.th/PPM/document/SEM2/Indonesia.pdf

Very interesting article. There was a lot of hype about advances in Oil Extraction Tech, like "...extended reach and horizontal drilling, advanced sand management, expandable screening and/ or electrical submersible pumps, drilled with minimally invasive drilling fluids, tight control of equivalent circulating density and high-precision geological optimisation of well placement"... We now know from the Handil Oil Field example, that there are huge limitations on how much extraction can be ramped up.

It will take a few more years for the reality to set in. We need someone to continuously challenge the MSM on this... :D

Way off topic:

Can somebody link me to a graph/chart/diagram showing net electricity import/export by state for the US? I can't google what I'm looking for well enough. Thanks.

I think you'll find what you're looking for in Gail's post here: http://www.theoildrum.com/node/3934 on the grid. If not, try the EIA.

Excellent and very clear article! I particularly like the scale question "How can you double something and still have ten times less than you started with?".

Scale is what people have most trouble with in regards to PO, there are plenty of examples:

Again, as I have stated before, I'm not saying to despair or that there's no hope - just that many people who I still talk to after several years refuse to understand the potential gravity of the situation due to the scale of it.

There's always something 'out there', whether EOR, not-yet-found-supergiant-fields, reserve growth or whatever, that will save the day. Something will 'come along' and 'save us'.

I find this type of betting on a positive black swan not only intellectually naive, but also potentially very irresponsible.

That is why I thank you for providing a clear and concise explanation for the likelihood of EOR 'saving us'.

We need more like this.

"merely extending the tail end of production in oil fields that are well past their own peak in production."

As a petroleum engineer I understand this better than the average person on the street. However the problem is in the lack of understanding of what "advanced technology" means as applied to raising production ( the magnitude and the point in life cycle of a field). This leads many to think that it will lead to solving our problems with production needed to meet current demand.

The real problem is the diagram showing the growth in reserves trend world wide. So far no technology that I am aware of is able to significantly change the trend we are observing now.

Good article !!!!

A student recently, and a colleague, sometime back, both brought me copies of Popular Science (or Popular Mechanics) with articles about how a new solar technology would solve all of our problems. They offered these as proof that everything would be fine. An awful lot of people read the popular media accounts of technology and believe these are the final words on the subject. It raises unrealistic expectations of what technology is, what it can do, and how it is developed.

The article points out an incredibly important issue - the law of diminishing returns. This law not only applies to marginal oil recovery per unit of energy consumed, it also applies to technology development itself. The vast majority of technological development is marginal improvement. Occasionally we get lucky and find a new physics principle (e.g. solid state electronics) that allows something like a quantum leap. But you'll note that this seems to apply to information technology more than production work. IT can be applied to production work to gain some marginal increase in efficiency (e.g. using robots to make cars). But processes that do useful work don't come under the miracle of Moore's Law (we have yet to see how nanotech machines will be applied to large-scale production work).

In the west we suffer from the innovation myth. We've seen so much innovation in one particular area - digital solid state electronics - that we transfer that observation to apply to all technology. And so, many people lack critical judgment when it comes to assessing the efficacy of technological solutions. Sadly this applies to politicos and policy makers (e.g. corn ethanol) as well as the general public. And sadly, it will be a block to a deeper understanding that would allow us to make real progress.

George

I bet you're thinking of A Solar Grand Plan: Scientific American. PV with storage in NG fields nationwide. Don't think many tech breakthroughs would be called for but gawd! what a monstrous amount of buildup. It's been hashed over here, do a search. And there have been a few other Grand Solar Plans proposed here, like Staniford's.

Innovation and scalability are the two things people just don't understand. What we need are short-and-sweet illustrations of the size of these hurdles. People can't grok page after page of reasoned documented arguments, they need something that they can take home, that can't be forgotten readily, like 1000 barrels a second or a cubic mile of oil.

If you check the comments on the Solar Grand Plan, you will see that it was pretty thoroughly disembowelled.

Turns out they wanted to use compressed air as the storage medium, and the process they suggested would use natural gas.

That would involve more NG than is likely to be available, apart from it's global warming implications.

Solar has a big contribution to make in providing peaking power, but even at the latitude of the Mohave winter incidence is only around 25% or so of that in the summer, so that you would need a massive overbuild to provide base-load.

That passes over the fact that you would also need to have dry cooling, which is expensive as it is a water-stressed area, and ignores the fact that even providing enough storage for overnight power is not easy or cheap.

Solar thermal is also dependent on really clear skies, far more than, say, amorphous silicon, so that back up power is also needed for up to a week, even for the Mohave, as I was informed by someone in the industry.

As for schemes to power the whole country this way, let alone run Europe from transmission lines from the Sahara, they are pure science-fiction.

PV power locally produced is a far better bet, although very expensive for the moment.

Anyone catch Al Gore's speech today? I'd really like to know who his energy advisers are. Maybe the same guys who wrote that SciAm article. I did read it and at the time just shook my head.

I actually designed and built solar energy systems back in the 80's. HUD sponsored demo projects and a few private projects. In fact that is how I got into computers - designing some of the first µ-processor based controllers for solar collection. I got out of the business when I realized that it probably took more total energy to make the glass, aluminum, copper, and urethane insulation, manufacture and deliver the collectors than the systems ever delivered to point of use. For the home owner - energy savings. For the nation - net energy loss.

In Gore's speech he emphasized the connectedness of energy, climate, and economics which was good. But in most of the proposed solutions I fail to see whole systems thinking being displayed. I also realize that the vast majority of people simply do not intuit the second law of thermodynamics. They don't grok ERoEI, or any of the real physical constraints that dictate energy engineering.

Scale and rate of construction of whole systems. I wonder what it will take to get people to think this way?

George

Just to echo your point SamuM,

A simple calculation with Excel shows that we will have to build roughly 16 one Gigawatt nuclear power plants (1-GWNPP) per year to compensate for just a 2.5% drop off after peak oil. For you trivia fans, a 1-GWPP produce roughly the same amount of energy per year as in 4.5 million barrels of crude. An interesting highlight of this is that in just 3 years, we would have to build roughly the same number of power plants and Senator McCain is proposing to build by 2030 as part of his comprehensive solution to the energy crisis. A 4.5% roll off requires around 75 1-GWNPP/year or roughly 1 1/2 per week. I think I'll go take my Zoloft now.

Said by Stephen Hubbard:

The comparison of the energy from different sources is not this simple because one must consider the efficiency when it is used. Although I do not know the enthalpy of combustion of crude oil, assuming electricity is to replace 4.5 Mb of gasoline to power cars, I get:

enthalpy of combustion of gasoline: 130 MJ / gallon

130 MJ/gal * 4.5 Mb * 42 gal/b = 24.6 x 1015 J

Because an electric car is 3 times more efficient than a gasoline powered one, this translates into an electric power plant operating continuously for a year with a power of:

(24.6 x 1015 J/year / 31,560,000 s/year / 3 = 260 MW

Edit: The CAFE Formula, Forum on Physics & Society of The American Physical Society, David Hafemeister, v36, n4, October 2007; states an electric car is 5.4 times more efficient than a gasoline powered one making my calculation too high.

This is also a good example of the depletion rates of fields using modern methods.

Looking at the graph it had significant production for about 10 years from 1977 to 1987.

Or about a 10% depletion rate. Then a steep drop at whats actually about 90% overall depletion

and a long decline at a much lower production rate. About 30% or less of the original rate.

Now whats important is that to replace this field one would have to find a field of the same size about

every 10 years.

You can keep overall production the same if you find 4 fields smaller fields but these tend to have shorter life times and are less economic to redevelop using advanced extraction methods. If the field is to small even secondary extraction may not be attempted.

We have thousands of fields like this in production right now that are approaching the end of their ten year primary production life.

In general we have no new discoveries to replace them. To keep production close to our current rate we would have had to find and develop enough fields within the ten year periods that our current smaller fields produce at a high rate to replace them.

For simplicity you can assume all the small fields where brought into production at t0 and at t10 ten years later you would need to have 100% replacement.

As long as new discoveries can be found and brought online fast enough oil production remains fairly level but once you pass the point that no new discoveries are made in significant numbers then about 10 years later all of the smaller fields will be in significant decline.

From the graph you have 10% of production from fields less then 10 years old but you can see that discoveries have dropped to a low level since about 1985. And most of this 10% only has a high productive life span of 5-10 years.

It should not be hard to see we are entering a time that 10% of our current production from a swarm of short lived smaller fields has a good chance of going into a steep decline dropping by 60% over a period of 1-3 years.

So in my opinion our immediate problem is not the slower declines of the giants and super giants with production life times that span decades but declines from these smaller fields from lack of replacement.

Once they are gone the decline will moderate to match the slower decline rates of the larger fields.

you fail to mention, as a significant drive mechanism, good old mother nature. i.e. gravity drainage. what is the typical reservoir dip angle on this field ?

i agree that eor has limited benifit in this case, because of the relatively high (gravity aided) secondary recovery. too few people grasp the concept of material balance, which in it's simplist form simply states that the amount of oil remaining is equal to the original amount minus the amount produced.

this sounds like a very complex reservoir, without some additional data, i find it hard to believe that secondary recovery could be in the 70% range without a significant gravity drainage contribution.

i know of examples where similar recoveries were obtained by waterflood, but guess what - steeply diping reservoirs. and not that good of reservoir properties, with the exception that the oil being of high gravity thus low viscosity.

memmel keeps banging on the theme that smaller fields can't replace bigger fields (which i agree with) and i keep banging on the theme of gravity drainage.

the percentage production figures are proportions of the total oil produced up to 2002, not percentage recovery of oil initially in place. you are right - recovery of oil in place in this field will not be anywhere near 70%.

gravity drainage will also not be significant for this field!

sorry, i guess i missed that part. what is the recovery % of ooip ?

sorry to disappoint, but recovery factors are not available in the JPT article. you'd have to ask somebody working for TOTAL in Indonesia..

Gravity drainage fields can really confuse the villagers. I have one such fld that has produced for 50 years (20 mmbo so far) and will produce for another 100 years (maybe another 20 mmbo). When the angry villagers hear such tales they begin to think there really is help out there for them. The wells in this field make about 1 bb/ per day. It obvious has no bearing on PO. But the little ma and pa operators are slowly becoming millionaires.

But what compounds the confusion are the public claims by oil companies regarding the great profitability of EOR these days. Those optimistic statements are valid with regards to the company's financial future but have a minimal impact on PO. The villagers will see many press releases from the public oils rightfully touting the profits of additional exploration and EOR. And we should count on these angry villagers to take those press releases as a sign that there really isn't a big problem with PO.

BUT: EOR and more exploration will delay PO. That's a point of logic that cannot be denied. But whether it delays it 5 years or 5 months is the question we can bounce around just for the fun of it. My guess would be NOT 5 years.

What are the rate laws that affect gravity drainage? Is it a first-order diffusional law, something akin to Fick's law? In that case, you will see a fractional power-law growth in cumulative reserve (specifically a square-root law if you work out the math) and the reciprocal of this for extraction. This kind of behavior does show the long tails you would see.

I suppose you can provide a more detailed analysis, but this kind of first-order look can provide a lot of context for those of us that come from different areas of expertise.

the basic's of gravity drainage are contained in d'arcy's law which stated mathmatecally is:

v = c(k/u)(dp/ds)

with a substitution v=q/A then c becomes 1.127 (usually presented with a minus sign, because dp/ds is negative)

where q is in bbls/day

and A is the x-sectional area of flow, sf

k, permeability, is in darcies

u, viscosity is in centipoise

dp/ds is pressure drop, psi/ft

for the case of gravity drainage dp/ds can be taken as (dp/dh)*(dh/ds)

dp/dh is the bouyancy of the oil or difference between the fluid gradient for oil and water, psi/ft.

= 0.433 (rhowater-rhooil), at reservoir conditions.

and finally dh/ds is the change in elevation over a distance. or simply sin dipangle.

and strictly speaking d'arcy's law only applies to single phase isothermal flow under steady state conditions. and for cases where the capilary pressure is zero(well above the oil/water contact)petroleum engineering usually makes lots of assumptions, so these restrictions are usually just ignored.

So this is actually Fick's Law of diffusion!

This in fact is very simple to solve. I have done a post on this behavior before (http://mobjectivist.blogspot.com/2006/01/grove-like-growth.html) and in actuality diffusion and dispersion are the same sides of a coin so it follows the same trending of the Dispersive Discovery curve.

Take the equation for d'arcy's law

v = c(k/u)(dp/ds)

and then substituting (dp/dh)*(dh/ds)

The key is the dh/ds term, the dipangle. The ds is essentially a displacement in volume as the gravity drainage starts to move material from one volume to the other. So whatever goes from one side of "s" goes to the other side, the "v" side. This means that the length of the partially drained volume gets bigger and bigger with time.

Look at the width in the following figure where x is the s term:

So x or s gets bigger and bigger with a cumulative increase proportional to the integral of v. With the small sin approximation for sin (dipangle) you get dh/ds = h/s

so rewriting this, replacing U with s to denote cumulative volume

dU/dt = k / U

this solves simply as U(t) = k * sqrt(t), which is Fick's Law. The bottom-line is that you get progressively diminishing returns over time.

Very good article. I like to apply what we learn from individual fields and apply it to a larger scale. In this case you can almost think of individual fields as Kroneker delta discovery function (the initial impulse) followed by a unit step function of lower rate that lasts for X years (the reserve growth).

If you scale the delta and unit step function just right, and then apply a convolution of a damped exponential (the extraction rate) to this stimulus, you arrive at something that looks quite like what you see.

If the unit step is lower in scale, then the initial decline sets in immediately, and the top plateau is not flat. And if you replace the delta and unit step with 2 declining exponentials of different shapes, then you end up with a 2nd order gamma function, and the whole profile looks smooth.

These components are what I refer to as "shocklets" and can be used to build up a macro model from the micro model we see on individual oil fields. The macro view is actually the heart of the Oil Shock Model that is often discussed on these pages. But sometimes it is good to see how this stems from the results on individual fields.

And a note to all the EE's and ME's out there: this stuff must look awfully familiar as the process mimics the analysis of linear response functions from an input stimulus.

thanks WHT

I just sent some of your stuff to a friend and maths lecturer at Latrobe Univeristy in Melbourne who will hopefully be using it as lecture material:

http://johnbanks.maths.latrobe.edu.au/

Phil,

Great article. One aspect about technology applications leaves me uneasy. The use of technologies to enhance production can fall into two types. One type is to improve production rate of an existing reservoir, produce what is there faster. Examples may include horizontal or multi-lateral wells. The second allows recovery of OOIP that would otherwise be missed, recover more of what is there. This may be like you cited, water sweeps or enhanced recovery. In the real world it may be some combination of the two.

Nominally if we refer to something like the Hubbert curves for production, the second type of technology increases the total volume under the curve. However the first technology influence only increases the height, but shortens the base of the production profile. It may also tend to skew the profile non symetrically into higher peak but more severe drop off on the down side.

I have no hard numbers but my gut instinct is that most of the technologies applies over the last 20 years have been to boost the production rates and maximize short term returns for the oil companies. While there have been advances in the improvements of recover factors, this is probably small compared to the improvements in the recovery rates. If we equate this to technology equivalents of production and discovery where production is the faster recovery and discovery is more effective recovery, we are "producing" faster that we are "discovering".

You must take into account that increasing the flow rate will help keep companies from abandoning a reservoir, altough I am not sure if that will hold after peak oil.

You're quit right about "boosting the production rates and maximize short term returns for the oil companies". Essentially oil patch economic decisions are dominated by “net present value”. NPV adjusts the cash flow to take into account the time factor. A fld producing 2 millions bo over 20 years has a much lower NPV than a fld producing 1 mmbo over 4 years. The common discount rate is 15%. Think of the DR as the interest rate on a loan. A 15% loan paying back $1.15 in one year would have a NPV of $1 and thus no profit would be made. The NPV factor is used to determine the rate of return on an investment. The stock market demands y/y improvements in a public company’s position. As odd as it may seem virtually all public corps would chose a high NPV approach to development over a low NPV approach even if it produced a greater ult recovery. NPV is especially important in those big Deep Water plays. During those long development phases (6 to 10 years) that 15% keeps compounding. If you look at the decline curves of the initial Deep Water Gulf of Mexico flds you’ll see high initial rates and relatively rapid declines. This is a design option chosen by the operators. You’ve heard it before: Time is money. And when you’ve sunk #1.5 billion into a project before it flows the first bbl of oil that time is very expensive.

On horizontal wells, they can also add significantly to ult recovery sometimes. I can’t recall a specific example but an increase of 20% or more is possible. But this would be a very field specific number. Another fld might only show a few percent increase. But you’re definite right about changing the decline curve significantly for many water drive reservoirs. Vertical wells are produced thru holes shot in the casing. In a water drive reservoir (as most big oil flds are) the water moves upwards as the oil is produced. If you have a oil sand 100’ thick you could just shoot holes in the top 1’. That would delay the water cut as long as possible. But you’re not going to flow much oil thru 1' of perforations. At the other extreme you could perforate all 100’ of the reservoir and get the maximum flow rate possible. But you would also start producing water almost immediate because you shot down to the water level. This would greatly reduce you ult recover from that well.

A horizontal well provides the best of both worlds. A 100’ long horizontal well in the top 1’ of a reservoir would have a very high flow rate but it takes a much longer time for the water to reach that top 1’. This greatly enhances ult rec. The well would also show a rather low decline rate for a long time. But imagine when the water level finally reaches that top 1’. That well could go from a great commercial producer to marginal in just months. It was reported that Saudi spent over $10 billion in the late 90’s drilling horizontal wells in Ghawar Fld. This would have given a big boost to flow rates and they would have shut in the high water cut vertical wells. This is the really scary aspect in estimating Ghawar’s future decline profile. I have no guess to how much of production today is from hz wells vs. vert wells. If the hz wells are the great majority the decline curve could have that big cliff drop off you describe...

and not be too many years down the road. And a company can easily monitor where the water level is at any one time. Saudi has a good estimate of when the SWHTF in Ghawar Fld but they're not sharing.

Very interesting (and scaring) comment. I have several questions:

"NPV is especially important in those big Deep Water plays." As oil exploration is increasingly moving to deep water this means that we have to expect that the recovery ratio won't increase but decrease compared to good old onshore fields, right?

As for the vertical wells: I know that in groundwater wells packing seals can be used to decrease the area of water inflow. So theoretically one could perforate all 100’ of the reservoir, and as soon as water seeps in stepwise reduce the inflow area to the upper part. Is this possible with oil wells?

Phil, a fascinating article which has had me glued to the flatscreen. Thanks.

One reservation. You write that “the two other case studies in the same issue [of JPT] showed only very mediocre gains”.

Well, I suppose that depends on what you call ‘ mediocre’. One of the two other studies concerned a Malaysian oil field (‘Betty’) and the results seem pretty good to me unless I’ve misinterpeted the data.

Here’s an extract from the conclusions of the Betty field production-enhancement study (page 62):

13% is quite impressive and 5 million barrels isn’t small fry!

Thanks. I was looking at the absolute production increment achieved in the other two fields. A few thousand barrels per day of extra production is not much to get excited about.

But you make a fair point.. i obviously didn't read them carefully enough (my head was buried in the Handil pages for long enough!). The other two articles are very short on important stats, which led me to think their story was not as convincing.

On Ecopetrol's Yarigui-Cantagallo field in Columbia, production was increased from 5,000 barrels per day in 2003 to a peak of 12,000 barrels per day in 2006 but declining again after that. Previously, the field peaked at 20,400 BOPD in 1962, after first development in the 1940s. Their EOR efforts appear to have added more than 25 million barrels of oil as reserves, but that still looks to be only about 10-15% increase.

For the Betty field in Malaysia, there's more detail here:

www.china-drilling.com/spe2006(beijing)/spe101491.pdf

The percentage increase in reserves due to EOR for these other two fields may be higher than Handil, but the absolute returns are a lot less. With smaller fields, you need a bigger percentage return to make it worthwhile. With a larger field, a few extra percent may be worth the effort, but there are nowhere near enough fields as large as Handil for us to add enough to total world reserves.

So in each of these two extra cases, we're talking about production increases of just a few thousand barrels per day. In terms of reserves increases due to EOR, we've got less than 10% in Handil, 13% for Betty and something similar in Yarigui-Cantagallo. And this is three of the best!

By the time you average that across all the world's all fields, with most returning even less (if anything), the typical return for EOR is well under 10%! That's not going to save us.

And I just found an electronic copy of the whole section of the JPT on which all of this was based so now everybody can read all three articles for themselves!

www.spe.org/spe-site/spe/spe/jpt/2008/01/2MatureField.pdf

princesses are turning into pumpkins here in oz, so lights out for me for awhile.

hopefully you can help me out with a few votes at digg/reddit and your other favourite hiding places:

http://digg.com/general_sciences/How_Technology_Increases_Oil_Production_2

http://www.reddit.com/info/6s7my

http://www.reddit.com/info/6s7op (technology section)

thanks!

Isn't that a really awful example of EOR-CO2?

OFFSHORE EOR-CO2 is still a NEW technology!

Look at Weyburn instead.

It has produced 350 million barrels of oil so far and with CO2 Schlumberger expects to produce another 130 million barrels. Beyond geology, the difference may be a huge steady source of CO2, the Beulah syngas plant in North Dakota.

http://www.seed.slb.com/en/scictr/watch/climate_change/weyburn.htm

IMHO, all you've proven is that different sites and different manners of development produce different results.

This presentation from Schlumberger gives some info on costs involved.

http://www.conferenceworld.com.au/resources/other/Dr%20Geoffrey%20Ingram...

When I first read your piece I thought you were stating facts--but your post is just negativity and premature defeatism. I hope it's not deliberate.

Sheesh!

majorian,

You're very right about the field specific nature of all EOR projects. Beautiful ponies and ugly dogs. And sometimes not too far from each other. Are you asking if offshore CO2 EOR is a new technology? CO2 injection projects have been around for many decades. But not very common offshore due to the logistics involved. Otherwise it’s pretty much the same process. An alternative to CO2 in nitrogen injection. Not quit as effective but can still work. And N2 can be produced right out of the air. Mexico’s huge offshore field Cantarell has the largest N2 generating plant in the world. They’ve used the N2 to maintain reservoir pressure to increase flow rates and ult recovery.

And why, Rockman is Cantarell being injected with N2 rather than CO2? Is it due to a lack of CO2 I wonder(NOT)!

My information from googling is that offshore EOR-CO2 IS new and it appeared that the Borneo project was in part of shore--in other words possibly experimental.

The Schlumberger link had numbers for CO2 sequestration, etc. When you talk about 'logistics involved' a little light goes off in my head--'Not economic...nothing to see here, let's move along'.

Frankly, I believe large scale tertiary oil recovery WILL require government support probably in the form of carbon taxes. A $100 per ton CO2 tax to cover costs would add about $50 to a barrel of oil. If the operating costs of sequestration of a ton of CO2 costs $50 per ton and you can recover 4 barrels of $100 per barrel crude oil obviously the EOR will still have to compete with other pet projects(magic nuke or solar plants for instance) for scarce capital. But oil is much more valuable than most people realize.

Perhaps nitrogen was cheaper to produce?

How ubiquitous is EOR, what percentage of fields worldwide has it been applied to - or analyzed and found not worth the bother? Hirsch includes it among his wedges, finding that it would be a substantial contributor to mitigation - more so than increased vehicle fuel efficiency.

All the CO2 EOR projects I know of use CO2 produced from underground reservoirs...mostly in the Rockies. If the new technology you're refering to is recovering CO2 from the atmosphere that would be big news. As you say, that would have multiple advantages especuially if the gov't kicked in as part of a green house gas reduction effort. My point was that CO2 injection itself would not be a new technology but sourcing it from the atmoshpere would be big news since it could be done anywhere that a CO2 supply doesn't exist. The reservoir mechanics of CO2 EOR are the same for offshore flds as onshore flds. There are many onshore oil fields in the world that would benefit greatly from CO2 EOR but they lack a local source of CO2.

Yeah Dude...I have to assume it was the cheapest or only option for them. I'm sure that N2 plant cost a bundle to build as well as operate. Just the horsepower required to raise the pressure to injection levels would require a lot of energy.

I was trying to be facetious. 78% of the atmosphere is N2 which is an unlimited supply, but concentrated CO2 is not so available obviously.

And no I am not talking about harvesting CO2 from the atmosphere but harvesting it from IGCC CCS coal-fired power plants where the exhaust stream is nearly pure CO2.

I'll have to take your word that offshore EOR is no big deal because I seen few such projects until this rather negative post which suggests EOR will not work and therefore a waste of money.

I'm sorry majorian...I did misunderstand you. I have no idea about the economics of harvesting CO2 from the atmosphere but I suspect it's either not economic or not technically feasible. Otherwise we would see a lot of it because it's a much better EOR gas then N2. On the other hand, CO2 recovery from a coal fired plant could be a very important aspect. Pulling the CO2 out of the emissions stream isn't cheap but if the CO2 could be sold for nearby EOR it would certainly be a win/win. It would require the coal plant be close to the EOR project but that concept isn't new. We've used "cogeneration" practices for years: an oil field needs a heat source to aid in recovery. Instead of just running a boiler an electrical generating plant would be built in the field and the waste heat would be used for the enhanced recover while the electricity would be sold. Typically the plant would be fired with natural gas produced from the field.

Offshore EOR projects are difficult to run economically just because of the logistic problems. But recently Shell Oil began what may be the first offshore water flood (injecting water into the oil sand to enhance ult rec). With sustained high oil prices we’re likely to see more efforts like this.

The "technology" of harvesting CO2 from the atmosphere is rather easy: Grow fast growing plants (e.g. miscanthus, jatropha or other 2nd gerneration biofuel-stuff), and burn or pyrolyse it in a plant using CCS (carbon capture and storage) technology.

The cost: According to a recent meta-study for the German parliament coal plants have additional cost of 26...37 Euro/t.

BTW: This means 50% higher electricity prices for gas plants and double electricity prices for coal plant (more than the expected price range of wind energy: 0,05...0,07 Euro/kWh).

I forgot to add: As you may imagine I am not a fan of CCS, but maybe our children and grandchildren desperately will need this method to pull at least some of the CO2 out of the atmosphere...

Handil is using natural gas, not CO2 for enhanced oil recovery.

The Society of Petroleum engineers ran a feature on Handil and the other two cases mentioned in comments above in their Journal of Petroleum Technology. That means these are three of the best recent examples of EOR - I don't think I can be accused of cherry-picking my data!

The great returns at Weyburn are a result of a very particular set of reservoir properties. We can't (edit typo) draw conclusions from there and apply it to the rest of the world.

The point I'm making in this article is that Weyburn is not typical. 10% extra reserves in a small sub-set of suitable fields is a more appropriate expectation for EOR. There will be a thousand oil fields where EOR is never applied, because primary/secondary recovery does a good job and EOR does not make a sufficient difference to overcome the enormous costs involved.

Actually I think I AM accusing you of cherry picking..and you didn't mention Weyburn. Why is Weyburn atypical? Look at the hundred or so of EOR-CO2 projects in the US. The Permian Basin(Texas) with EOR-CO2 recovery alone could yield up to 1 billion barrels of oil according to the brochure below.

The US DOE says EOR(thermal, surfactant and gas)will increase the overall oil recovered by 30-60%. Is this merely propaganda? Are they all cherry picking? The US currently produces .6 mbpd from existing EOR projects.

http://www.ogj.com/articles/save_screen.cfm?ARTICLE_ID=326310

http://www.fossil.energy.gov/programs/oilgas/eor/

http://www.netl.doe.gov/technologies/oil-gas/publications/brochures/CO2B...

Which thousand oil fields will never have EOR? Why not?

There are billions of barrels of oil that will be recovered from the world's oil fields by methods which have been extending US fields for 30 years.

I can't imagine why you think it can't be widely applied.

"I can't imagine why you think it can't be widely applied."

imo, co2 will be widely applied. however, there are many many fields where bringing co2 to the field is simply not economical, and this would apply mainly to small fields, and fields that have already achieved a high recovery.

many small fields are not even served by an oil pipeline to move the crude oil to market (the oil is trucked). it is difficult to see how a co2 pipeline will get built. trucking co2 is probably not going to improve the economics either. some of the early efforts in the permian basin were supplied with co2 via truck. these were experimental projects and were never intended to make money.

capturing co2 might someday have widespread application, however nearly all the projects currently in place are supplied with co2 from underground sources.

A good way to look at the problem is to take every field currently in production and map it either to EOR or to a new field coming online.

In the past the number of field in production that where in decline could be mapped to on or more new fields coming on line. By doing it this way it makes the problem very simple.

What you would find if you did this sort of mapping is we face two problems 1 many of the current fields in production are in the second half of their production life i.e they are mature and will begin declining within lets say 1-10 years depending on the field. Next few of these fields can be mapped to a replacement project.

Most people studying peak oil focus on the rise and fall of production of single fields averaged to produce a bell shaped curve. However as discovery is well in the past you also have the problem of lack of replacement for fields. The aggregate production level of the smaller fields depends on the ability to find and produce a replacement field every 5-10 years. Without these replacement prospects smaller companies that focus on these smaller fields don't have the Reserve levels to draw in capitol to do EOR. Doing EOR on one asset of a company with reserve growth is different from financing EOR for a company with only declining reserve levels.

You can see that the financial side may well change quickly and probably won't support EOR for a lot of fields.

Hi memmel. Mapping old fields with new fields or EOR projects makes the problem quite clear. The financial ability or inability as it were of companies with declining reserves to do EOR seems to be problematic as well. Do you think an escalating crude price can mitigate this financial constraint on companies declining reserves or does the problem also migrate into the EROEI area? Thanks.

Don

:)

I think the EROEI and simple energy return on investment are a huge issue for EOR methods. And most sidestep it and focus on marginal profitability.

Maybe a better way to look at it as as we reach the point that EOR methods are providing a significant amount of oil with low EROEI values where does the money go ?

Into EOR or somewhere else. If you look at it from a financial perspective your a lot better off buying fields that are still producing and consolidating production then performing EOR.

So EOR will not get the investment money it needs. In fact I think that as the return vs investment for EOR vs growing reserves through mergers argument means EOR will not be widely deployed.

The financial decision is almost trivial you have Company A experiencing declining reserves and Company experiencing declining reserves. If you merge the two companies magically the new company gets a big reserve boost with what is basically a accounting trick.

Next of course the decision to do EOR on the merged fields can be made based on the best choice of the merged assets so basically the best one from the total pool not both companies doing the best EOR candidate from the split reserve base. The net result is on marginal field would not undergo EOR because of the merger.

Underlying this is regardless current EOR projects cherry pick the best candidates and these get the investment. As this pool declines the return on investment for EOR overall declines and makes it less profitable vs merging companies.

And of course backing all this is the net EROEI for EOR is much lower then regular production methods.

Its wrong to count EOR barrels as equal to barrels produced using less energy intensive extraction methods.

The right way to treat oil is the top barrel of oil is Light Sweet from a large field it has the highest value and highest "future value". By this I mean that the chances are high that this same field will produce a barrel of oil next year. All this means is a barrel of oil should be weighted by the size of the reserve backing the extraction of the barrel times extraction cost time refining cost.

So 1 Weighted Barrel = Quality * depletion rate * extraction cost * refining cost * EROI * EROEI

I put the same numbers in multipl times since Quality === refining cost etc but this is just to be clear what some of the real discounts should be.

What this is is simple a more realistic BOE ( barrel of oil equivlent ) With the best light sweet from the largest field set to 1 and all other oils discounted.

What really funny is the markets do this all the time and price discounts can be huge but when people talk about oil production they ignore the need to weight barrels to get the net value.

Sometimes this is called peak light sweet etc.

If you include time in the argument Export Land is actually barrel of oil that have negative future value since they are used in the exporting countries to increase demand and lower exports.

And by including time you can see that a barrel of oil extracted from a small reserve that cannot be replaced by new discoveries has a bigger negative value in the future then one extracted from a larger reserve.

This is because you have a higher chance that EOR won't be applied to the smaller field.

Anyway you churn through all this and you can easily see that we are making our net future BOE drop a lot faster than the nominal equally weighted barrel. In some cases like the tar sands the net return of energy is half that of other barrels.

This is covered to some extent in this thread and on various EROI posts made on the Oildrum.

http://www.peakoil.com/fortopic39163-0-asc-0.html

Another factor is that even with low value EOR extraction you get a short term boost by the fact that EOR canidates have their own discovery model but its the cherry pick model not dispersive like original discovery.

This cumulative increase in production rate by using EOR on the best candidates early adds its on negative future production value to my weighted barrel of oil.

And you get the same cumulative discount by extraction of a lot of small fields that decay fast. Once these can't be replaced you lose the production rapidly. The sum of extraction of a lot of small fields in parallel is worse then simple addition of reserves wound indicate.

So we are increasingly worse off over time then simple production concepts would indicate.

If you will our ability to gain net energy or profit from oil is declining rapidly.

This may be esoteric but its not since eventually this has a profound impact on investment.

If you consider the .com crash or the housing bubble crash or any other investment scenario once

investment sentiment sours it does not matter how good your idea is the money simply is not there to fund it.

For example you here plenty of stories today about people who are good candidates for buying a house getting turned down for loans. Just like after the .com crash I don't care if you where the next MS and had the best business plan on the planet you would not get funded.

The Oil patch is in for a rude awakening as it finds that high oil prices alone will not garner funding esp for EOR. Concern about economic collapse will be the big Elephant in the room but the lower net profitability from above considerations also has a big effect in turning investment sentiment agianst the oil patch.

Now of course the reason that the economy is collapsing in the first place is that net energy from oil is decreasing rapidly. A perfect catch 22.

Investment sentiment will eventually recognize this and the result is they won't put money into EOR.

The reason is that EOR cannot halt the increases in oil prices. They continue to spiral upwards directly damaging the economy and providing lower net energy also directly damaging the economy and making future demand uncertain. Once investors get a bad case of the FUD's (fear uncertainty and doubt ) its over.

Sorry if this response is convoluted but its important to realize that the flow of dollars into the oil industry is probably going to decline since the oil industry cannot stabilize prices.

yes, i suppose it is a little convoluted. if eor were easy and there were no risks involved, harkin energy probably would have figured it out.

i am not as pessimistic as you are about eor, for one thing we have much better tools today than we did back in the '70's. the majors built a co2 pipeline from the four corners area to the permean basin about then. now that took some balls! and this is not a technology will save us issue, but maybe technology will help.

still, there are risks, and for that matter, there are probably a lot more waterflood failures than many realize. i could probably write a book (if i weren't so damn lazy).

if other people's money is at risk, though it wont seem quite so risky.

Thanks for the weblinks. But I wonder what you want to tell us with them. If you want to say that EOR will have a huge impact, then you scored your own goal with the first link. There the headline says:

"More US EOR projects start but EOR production continues decline".

I think this says enough...

Does anybody know anything concrete about Gull Island. Petroleumnews.com had an interesting article about this mysterious field.

Concrete? That would be the content of the brain of anyone who takes Lindsay Williams's fantastic stories at face value.

The idea that the Powers That Be in the USA have the foresight and patience to sequester a multibillion barrel field for decades is laughable.

This is religion at its worst, Oil Creationism, from a loony Pentecostal Protestant, You used to be able to subscribe to his news letter for just 25$ US where he would tell you just what you wanted to hear, That "Jesus" will keep the well at Gull Island full for all eternity or until the "Rapture" judgement day. So if you pray hard enough G.O.D. will put more Oil in the ground, just for you. :)

I have no data on Gull Island but I suspect no one else does. But consider this fact: just a guess but I suspect there has been at least 20,000 folks who have worked in this area for the oil companies over the decades. If it is there the big news would be that 19,999 folks(including welders, truck driver, cooks, etc) have kept the secret. You can decide for yourself if that a reasonable expectation.

The shales, like the Bakken, present a much different dynamic to tech change and flow rate than the conventional reservoir. The deal with the Bakken is that there is a massive amount of light sweet oil there (many Ghawars), but very little of it is recoverable by the usual methods (about 2%). The immense problems of getting this oil out is viewed as a dark cloud, but there is an interesting silver lining. The fact that virtually all of the reservoir has the same tech problem and that the reservoir is so huge makes the Bakken more levered to technological improvement than probably any other source of energy in the world.

This can be seen graphically by charts like the one in Piccolo's excellent article (April 26 TOD):

The first blip in production in the 70s was the first conventional vertical wells. With each tech innovation, the production response is massive - much more than the 5% or so messing around with old conventional reservoirs!

With the current multi-stage horizontal frac idea, production isn't expected to go much beyond 300,000 barrels/day. But it makes you wonder what will happen if the radio wave conversion of rock into oil being worked on by Raytheon or the chemical-down-the-wellbore conversion idea being worked on by Chevron will ever pan out in a few years.

"what will happen if the radio wave conversion of rock into oil being worked on by Raytheon"

shale oil - vs - oil shale.

in reality, the current crop of bakken oil is not even shale oil, but is produced from the more conventional middle bakken which varries a lot from silt to sand and carbonates. the oil is presumably sourced from the shale zones.

most of the early production in the bakken came from the upper and lower shales. one early field, the sanish, apparently produced shale sourced oil from a sand in contact with the shale.

I've also read that some operators are planning to concentrate on the sandstone immediately below the B Sh. Don't recall it's name but there's an older fld that has had some good recovery from it. It'll probably take a while to figure out the best approach. Took about 5 years+ and a lot of wells as I faintly recall in the Barnett Sh.

The multi-frac technology is really coming on strong. In E Tx we're up to 11 and 12 stages working just fine.

"...the sandstone immediately below the B Sh."

you are probably thinking of the three forks. but actually, i believe that is a dolomite. named, after the dolomite near three forks, montana, the site of lewis and clark caverns.

the sanish field in nd is completed in the sanish sand, just below the lower bakken shale. the sanish field was discovered in the '50's, and i think on land owned by henry bakken.

That sounds better elwood. BTW...this just popped up on Rigzone. You can expect XTO to hit it hard. They have their own corporate PO looking them in the face. They need to ramp up efforts very fast.

XTO Energy Inc. has closed its previously announced acquisition of producing oil properties from Headington Oil Company for $1.05 billion in cash consideration and 11,742,391 shares of XTO common stock for total consideration of $1.8 billion. The purchase includes 352,000 net acres of Bakken Shale leasehold in Montana and North Dakota. XTO Energy's internal engineers estimate proved reserves on the properties to be 68 million barrels of oil equivalent, of which 60% are proved developed. The acquisition

will add about 10,000 barrels of oil equivalent per day of production. In addition, the Company has agreed to acquire 100,000 net undeveloped acres in the play and 400 barrels per day of production for approximately $115 million from undisclosed parties in separate transactions.

"With these deals, XTO now becomes a leading operator in perhaps the largest oil resource play in the nation, with more than 450,000 net acres. As with all our other acquisitions, our objective is to more than double the proved reserves through the application of cutting-edge technology. Given the opportunities in the Bakken through horizontal drilling, multiple stimulations and enhanced recovery, we anticipate the potential for even more," said Keith A. Hutton, President. "Currently, our team has four drilling rigs at work with plans to increase the activity to six rigs during the first half of 2009. Early well results are encouraging with a recent producer, completed in the Middle Bakken, flowing at a rate of 650 barrels per day. At the same time, we have expansive coverage of the emerging Sanish-Three Forks play as established by production rates on offsetting acreage. XTO will soon spud its first horizontal well into this interval."

Maybe I'm missing something but according to fig.3 the amount of oil discovered seems to greatly exceed production so far. Does that mean peak oil should be some years in the future?

No, when I eyeball it looks like peak right about now. Remember the production curve is wider so you have an optical illusion on your hands.

This is a very interesting posting with very helpful comments. And quite handy as I am desperately looking to get a clearer idea of how far the much proclaimed statements of the “optimists” are true or false. They say:

“Innovations and technical progress” will mitigate the supply problem. And the higher prices facilitate the application of very helpful technologies like EOR. But I am missing clear evidences or numbers – nor from the optimists nor from the pessimists.

My problem: There are many examples – either optimistic ones from the industry (“we can double the flow rate”) or more pessimistic / critical ones like the ones presented here – but of course an example is not an evidence. And it does not provide general information about the average or total worldwide situation.

What I need is information of this type:

Within the next 10 years on a global scale EOR can

- increase ultimate recoverable reserves by 5%

- increase ultimate production rate by 1%

- postpone / advance peak oil by 2 years

- decrease / increase decline rate by 0,2%.

The numbers above are just examples. Does anyone know relevant statistics or estimates??

Maybe the most useful information I found here is majorian’s weblink to Oil & Gas Journal’s exclusive biennial enhanced oil recovery (EOR) survey, which might provide some overall data

( http://www.ogj.com/articles/save_screen.cfm?ARTICLE_ID=326310 ).

However I don’t really know how to deal with these data, e. g. how to refer these to overall production data. Can anybody help? (Notification by email welcome)

Your missing that the production rates under EOR are often only a fraction of what they are under primary and secondary recovery. Thus the amount of production lost is larger than the nominal continued production level.

Oil prices respond to the difference in production and EOR does not change this equation all that much.

EOR cannot stop the spiral in oil prices that will continue to increase until the Non-Negotiable American Lifestyle becomes negotiable.

Given the recent price increases and export land its a pretty safe bet we will hit this point in less than five years.

Given the jaded attitudes of most Americans I don't think the negotiations to end our wasteful lifestyle will go well.

EOR like the electric car is a sideshow.

drillo,

My classic smart ass answer to your valid question would be that all the statistics folks are throwing at you are valid but none are correct. The obvious difficult part is integrating them into one big net picture of the future. EOR and new drilling are going to add production rate. The problem is the gain vs. the loss of existing production rates. Here's my suggestion as to the two critical factors. Focus on these and the big picture may be easier to visualize. First, so much of current production comes from mega fields (i.e. Ghawar and Cantarell) that their future decline rate will have a huge impact on net daily production. Second, on the other side of the fence, focus on indications of demand destruction brought about the increase of oil price to date. IMHO, it's this race between mega field decline and DD that will shape the face of PO both long and short term.

Many of us here enjoy sharing and commenting on the details of the situation. I, myself, get tickled every time I see someone has actually read one of my ramblings. But don't let us confuse you and distract from the bottom line: where are oil prices going and how will they effect life a you know it?

Dear Rockman, dear memmel,

thanks for your replies, but this is what I already know. But what I need is real facts and numbers, because I want to do some publishing targeted to non-experts, including politicians.

Maybe the oildrum-insiders are convinced of the "big" decline and "little" effect of EOR etc. But it won't be possible to convince "outside" people, that this is a serious issue as long as they don't get facts but just guesstimates and seemingly arbitrary examples. That is what the "other side" has lots of, too. I thought that the "peakists" here have a more solid base than the "cornucopians" over there, right? So please get it out to the public!

I get your point drillo. Your goal is admirable but here's the big problem. Everyone here (and every where else, for that matter) is stuck with evaluating all the different aspects (EOR, exploration reserve targets, etc) from production rate data. This data is available on some levels. But the potential rate increase from applying EOR to the X Field in west TX can't be estimated from its current flow rate and some average EOR recovery number. The operator of the field may have some very hard estimates of the net effect. But you and I don’t have that info…just his estimate and then only if he chooses to make it public. The same goes for Company Y saying they have discovered so many millions of bbl of oil with a new well. Or that Company C has so many millions of bbl of oil reserves proven on their leases. But the specific data needed to confirm any of these numbers is not available to the public or the gov't. I do such evaluations for a living and my data base has to come from the owner of the property. Even if the data owners were to make all this info available there are not enough geologists and engineers available in the world to analyze all the info in your life time. I've been a petroleum geologist for 33 years and can't evaluate most of the situations you read about. Memmel et al do a great job pinning the bits and pieces together to paint a broad picture. But if you're talking about presenting an analysis on some absolutely defensible level it's really not possible. As I said, I'm a pro at this: present an interpretation or production expectation and I can tear into with technically legitimate alternatives. All you have to do is tell me which way to go: kill the idea or sell it. In that sense it's a lot easier to make generalizations regarding the global situation then to try to break it down into small packets of specifics. To be brutally honest, even when the geologist/engineers have ever little detail stored away in their data base we still, sometimes, can only come up with a “guesstimate”. I just drilled a $148 million dry hole last fall. You might say the operator’s guesstimate was off a tad. In many ways the situation is similar to a trial by jury. You may seldom get a 100% agreement but you still come in with a verdict. And even when there is a unanimous agreement it doesn't mean they are right.

Dear Rockman, thanks for your reply. I understand that it is difficult to get an overall information but I'm still not giving in.

Maybe the data from the Oil & Gas journal I mentioned before are a good start (http://www.ogj.com/articles/save_screen.cfm?ARTICLE_ID=326310 ). It says: "OGJ’s survey shows EOR contributing 643,000 b/d to US oil production (Tables 1 and 2), a 9,700-bo/d decrease from the 2006 survey." This contribution from the surveyed 184 active projects is 7,6% of the total US production of 8,481,000 bbl/d in 2007. I have asked OGJ what they mean by “contributing” and am awaiting their reply.

Furthermore another interesting source of information might be the OGJ Research Center report “Future Global Oil & Gas Supply: A Quantitative Analysis” to be published on 1st of August.

Dr. Rafael Sandrea already gave sort of a preview in an article in the conservative German newspaper FAZ.

Here is a rough translation of the main points:

„Theories of the limited oil are fairy tales “

01. July 2008

…

The study shows that the ultimative oil resources are estimated at 14 trillion barrel. Of this three trillion or 21.4 per cent are especially heavy sorts, like the oil sands in Canada and at the Orinoco. 1,6 trillion barrel or 11.4 per cent are heavy sorts. For the moment 9.4 trillion barrel form the backbone of the oil industry more easily oils. They correspond to about two thirds of global oil resources.

Only a small part of the traditional oil fields has been produced

Of the traditional deposits, excluding the extra heavy types of oil, so far about ten per cent were thus produced. The reason: The yield is so far comparatively small, with approximately 22 of the oil in place. That is because of the economic logic: Until recently it was easier to increase production by discovering new resources in other regions of the world, instead of taking out the last drop of oil from of the well-known fields. Therefore approximately 90 per cent of the oil in place is still left in the ground.

In the meantime however the economic constellation has changed. Since it became more difficult to discover new resources the global oil exploration and development costs in 2006 compared to previous year rose by 29 per cent to 14.42 dollar per barrel. This way two decades of with stagnating exploration and discoveries take revenge. The oil reserves, which is the result from resource times yield, increased in the past ten years by 18 per cent or 120 billion barrel. Of it only seven billion were from new discovies in the past five years.

The necessary investments for the development of more difficult resources of oil in deep ocean are between four and six dollar for each additional barrel of oil. The costs of the processing of heavy oil sands in Canada and at the Orinoco in the recent projects of this kind are between 4,3 and 6.25 dollar per barrel.

EOR and IOR methods offer favorable possibilities for production increase

In contrast to this the additional investment costs for the so called „enhanced” and „Improved oil Recovery “ (EOR and IOR) methods are clearly lower, being approximately two dollar per barrel oil. These are secondary and tertiary technologies, which clearly increase the yield of oil fields. So the oil can be pushed out of the ground by water or gas flooding.

…

A further increase can be reached with EOR methods. The water used for flooding is for example artificially thickened by polymers, so that also oil of high viscosity is displaced. Or carbon dioxide is injected, washing the oil from the pore space…

Further production increases are possible with the combination of the innovative horizontal drilling technology with the so called Frac technology…

Such techniques are worthwhile, but were so far hardly used. According to Sandrea’s estimate only three per cent of world oil production are based on EOR technologies. This, althoug EOR could the improve the production of mature deposits even within a short time or at least keep production at the same level. On a long-term basis the yield of the deposit would increase.

They can clearly increase the exploitation of the deposits

On a global average the yield far is approximately 22 per cent, but individual examples show what is possible using the correct technology: The yield of the Statfjord field in the North Sea is 66 per cent and those of the American Prudhoe Bay 47 per cent. In the long term yield rates of 70 per cent seem possible with light, middle and heavy oils, whereas with specially heavy sort a rate of 30 per cent appears realistic, says Sandrea.

Rafael Sandrea assumes in its study that the yield increase by one per cent from well-known deposits increases the reserves by 100 billion barrel. That would correspond to the oil production of approximately four years.

Altogether this points to the fact that the market’s present doubts about the oil supply could be exaggerated. When the market come again to it’s senses, a price correction might hardly surprise.

The article has also a table of Sandrea's Resource estimations :

Sandrea doesn't tell about the effects of EOR on flow rates, nor on the costs and EROEI of EOR.

I should mention that Dr. Sandrea is also President of IPC Petroleum Consultants, Inc., a Tulsa based international petroleum consulting firm which specializes in oil and gas reserves appraisals and risk analysis for international upstream petroleum investments (http://www.ipc66.com/about.html ). So this publication might be favourable for his business.

drillo,