Under the Pump

Posted by Phil Hart on March 2, 2008 - 5:57pm in The Oil Drum: Australia/New Zealand

Peter Weekes is just one of the 'peak oil aware' journalists with The Age in Melbourne (Fairfax Media). Here are some quotes from his article in yesterday's Sunday Age:

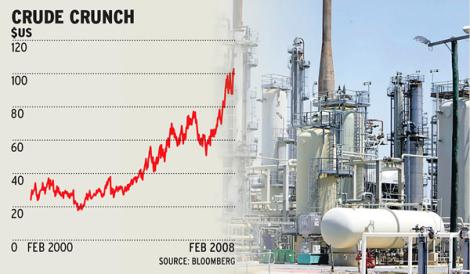

IT WAS not just motorists who were in for a shock as the the price of oil passed $US103 a barrel for the first time in history on Friday. The soaring price of "black gold" is likely to affect everything from airline travel and taxis to investing, and even what you can afford to put on your dinner table.

...

What all analysts do agree upon is that the days of cheap oil that have lubricated the world economy are over.

...

Oil output is already falling in 60 of the world's 98 oil-producing countries. Aggregate oil production in the OECD peaked in 1997 and has been in decline ever since. Many experts now say world oil production, excluding the 12 members of OPEC, will peak soon after 2010.

...

Recognising the emerging energy crisis, many of the world's leaders, particularly in the US, are hoping biofuels will provide the answer. But according to critics, a reliance on biofuels will create new problems. In his recent 2008 Outlook, Goldman Sachs commodity chief Jeff Currie suggested vulnerable regions of the world faced the risk of famine over the next few years.

We can't ask for much more than this in a major newspaper. Hooray for Peter.

One final quote that did make me smile:

Even without an increase in these speculative investments, Goldman Sachs reckons oil could hit $US105 a barrel this year.

You mean there's a possibility that oil might rise another two dollars this year? Genius.. we should pay those guys more!

$180/bbl during Q4/08, I say. The only thing that can stop it is if the US economy goes tits-up first. I think most likely the oil price rise and US economic troubles will run together, each reinforcing the other.

In theory the world's largest economy declining should drop oil prices, but I've no doubt that China and India will snap up the spare production. Put it this way: if we added 5Mbbl/day production now in March, we'd expect it to be taken up by the end of April, yes? Likewise, if US demand drops by 5Mbbl/day, it'll also get slurped up quickly.

If nothing else, rising prices will make countries anxious to fill up their strategic reserves, on the same principle as my old landlady saying, "What, you didn't buy a house? But prices are rising, so you should buy soon!" Which then helps prices rise, so... :)

Slowly slowly the world is acknowledging the problem, little notes here and there popping up in the press, like a little mouse poking its nose out of the siding to see if the cat's around...