Locabucks: Are local currencies a way to escape the liquidity trap ?

Posted by Big Gav on October 11, 2008 - 10:55am in The Oil Drum: Australia/New Zealand

Locavores, locastores and locavolts have caught my attention lately - 3 strands of the "relocalisation" idea that tends to get a lot of attention in peak oil circles.

Another localisation oriented idea that gets less press attention is the concept of local currencies (or "locabucks" as I'm now dubbing them), an idea which has its roots in the Great Depression as a mechanism for escaping the liquidity trap - and thus might be relevant again in the not-too distant future if present trends continue.

Local currencies in the 1920's and 1930's

The most frequently cited examples of local currency were issued in the Bavarian town of Schwanenkirchen and the Austrian community of Wörgl, described in this article on "Laboratory readings: Wörgl's Stamp Scrip – The Threat of a Good Example?":

On July 5th 1932, in the middle of the Great Depression, the Austrian town of Wörgl made economic history by introducing a remarkable complimentary currency. Wörgl was in trouble, and was prepared to try anything. Of its population of 4,500, a total of 1,500 people were without a job, and 200 families were penniless.

The mayor, Michael Unterguggenberger, had a long list of projects he wanted to accomplish, but there was hardly any money with which to carry them out. These included repaving the roads, streetlighting, extending water distribution across the whole town, and planting trees along the streets.

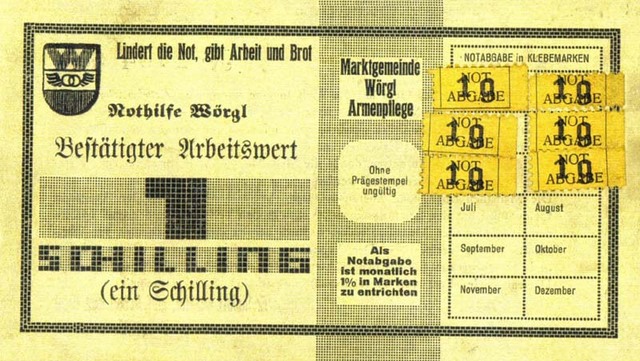

Rather than spending the 40,000 Austrian schillings in the town’s coffers to start these projects off, he deposited them in a local savings bank as a guarantee to back the issue of a type of complimentary currency known as 'stamp scrip'. This requires a monthly stamp to be stuck on all the circulating notes for them to remain valid, and in Wörgl, the stamp amounted 1% of the each note’s value. The money raised was used to run a soup kitchen that fed 220 families.

Because nobody wanted to pay what was effectively a hoarding fee [technically known as 'demurrage' and often referred to as "negative interest"], everyone receiving the notes would spend them as fast as possible. The 40,000 schilling deposit allowed anyone to exchange scrip for 98 per cent of its value in schillings. This offer was rarely taken up though.

Of all the business in town, only the railway station and the post office refused to accept the local money. When people ran out of spending ideas, they would pay their taxes early using scrip, resulting in a huge increase in town revenues. Over the 13-month period the project ran, the council not only carried out all the intended works projects, but also built new houses, a reservoir, a ski jump, and a bridge. The people also used scrip to replant forests, in anticipation of the future cashflow they would receive from the trees.

The key to its success was the fast circulation of scrip within the local economy, 14 times higher than the schilling. This in turn increased trade, creating extra employment. At the time of the project, Wörgl was the only Austrian town to achieve full employment.

Six neighbouring villages copied the system successfully. The French Prime Minister, Eduoard Dalladier, made a special visit to see the 'miracle of Wörgl'. In January 1933, the project was replicated in the neighbouring city of Kirchbuhl, and in June 1933, Unterguggenburger addressed a meeting with representatives from 170 different towns and villages. Two hundred Austrian townships were interested in adopting the idea.

Unterguggenberger was opposed to both communism and fascism, championing instead what he referred to as 'economic freedom'. Therefore, it was deeply ironic that the Wörgl experiment was first branded 'craziness' by the monetary authorities, then a Communist idea, and some years later as a fascist one.

The Wörgl experiment was watched by John Maynard Keynes and Irving Fisher, who saw a fast-depreciating currency as a possible answer to the 1930s "liquidity trap" and documented the subsequent use of "scrip" in the United States (Fisher is also infamous for predicting, a few days before the Stock Market Crash of 1929, "Stock prices have reached what looks like a permanently high plateau.").

Wörgl's venture into local currencies ended when its scrip was declared illegal by Austria's central bank in 1933, after a further 200 other communities commenced launching copycat currencies, threatening the monopoly of currency issuance by the state. The town went back to 30% unemployment. In 1934, social unrest exploded across Austria.

The Schwanenkirchen effort had a similar outcome - in November 1931, the German Government passed an emergency law ending the circulation of the "Wara".

Local Currencies Today

Local currencies are still alive in central Europe today, with something like 65 regional currencies competing with the Euro, according to Ambrose Evans-Pritchard.

Local currencies are still alive in central Europe today, with something like 65 regional currencies competing with the Euro, according to Ambrose Evans-Pritchard.

The most frequently cited example is the Chiemgauer - a local currency (also called schwundgeld, scrip or specie) accepted by 550 restaurants, bakeries, hairdressers, co-operative banks and a network of supermarkets in the Bavarian region of Chiemgau (though petrol stations remain a glaring exception, other than some biofuel outlets). Notes are used like legal tender and can even be accessed by debit card.

The Chiemgauer was issued in January 2003 at a rate of 1:1 against the euro, and is designed to lose 2pc of its value every quarter. Usage is reportedly expanding by 70pc a year, though monthly turnover was a meagre €135,000 when Evans-Pritchard wrote his article.

Evans-Pritchard says the Chiemgauer is one of 16 regional currencies that have emerged across Germany, Austria and northern Italy since the launch of the euro five years ago, with another 49 regions in the pipeline. They are mostly issued by activists, farmers, eco-enthusiasts, anti-globalists, and citizen committees.

The actual turnover of these currencies remains miniscule, so the Eurozone authorities are relaxed about competition for the time being. The Bundesbank is keeping an eye on them however, publishing a report titled "Regional Currencies in Germany, Local Competition for the Euro?".

Local currencies aren't restricted to the Germanic world - there are some examples alive and well in the Anglosphere as well, including Ithaca HOURS, Berkshares (which have gathered some mainstream media attention) and the Totnes Pound. Dutch organisation STRO is also implementing pilot projects in Brazil, Central-America, Asia and the Netherlands.

John Robb thinks local currencies are a useful tool for building resilient communities, but notes that they remain "a lifestyle choice" at present. Robb believes that the Worgl experience in the 1930's indicate that scrip "adoption, velocity and robustness" could be accelerated by:

* Allowing community members to use it to pay all or part of their tax liabilities to local governments. This instantly establishes a market for the currency. Also, pay local government employees a portion of their wages in scrip.

* Deflating [devaluing] the value of the scrip (optimally, one percent per month) to promote immediate use rather than hoarding.

* To the extent possible, connecting scrip to local production rather than retail. Locally produced food (farmer's markets), energy (via local microgrids), products (personal fabs), and labor/services. Further, work with local banks to establish checking accounts for scrip and to enable conversions hard currencies (at a slight discount).

Local Currencies And The Environment

Another reason for interest in local currencies has sprung from ecological concerns, outlined by Bernard Lietaer as follows:

The most recent reason for interest in stamp scrip and similar alternative monetary systems in the West or in Japan [Otani 1981; Henderson, 1981; Kennedy, 1988 ; Suhr,1989] results from environmental concerns.

"The higher the money-rate of interest, the higher is the pressure on entrepreneurs to avoid internal costs, that is, to externalize into the environment as much as the cost as is possible. Thus under neutral money, when interest goes to zero, this additional burden on resources will cease" [Suhr, 1988, page 112].

When it pays more to cut a tree, sell the wood and let the proceeds earn interest than simply let the tree grow, it is predictable that "economic pressures" will be felt to cut more trees than is optimal from an ecological viewpoint. Stamp Scrip would reverse that process. It is interesting to notice that this point was also demonstrated in practice: indeed during the experiment with stamp scrip in Austria during the Depression of the 1930's, the incentive for not hoarding was such that people preferred to invest in replanting trees.

As ecological concerns are gradually creeping to the top of political agendas worldwide, this aspect alone justifies the experimentation suggested in this note.

These three objectives: spontaneous creation of employment, inflation control, and ecologically conscious growth are the three results that eonomists can predict from the introduction of stamp scrip.

However, even more persuasive than any theoretical discussion is compelling evidence from case histories: such systems have indeed been used in the past in a variety of cultures, sometimes for centuries, and have always had a significant positive impact.

Conclusion

Local currencies can be an effective tool for enabling communities to escape from a liquidity trap, however they appear likely to remain in common use only as long as liquidity is in short supply or inter-regional trade is heavily restricted (or, perhaps, biased).

Retaining convertibility into other stores of value (a hard currency, or a commodity such as gold) is important to avoid pitfalls like the "company store" phenomenon, where the people being paid in scrip have no way of redeeming it for goods outside a very restricted set of businesses.

Ensuring that scrip is devalued at a well understood rate is also important to keep the velocity of money high.

Postscript - Silvio Gesell and "The Ascent of The West"

The idea of local currencies was first described by Silvio Gesell, in his book "The Natural Economic Order".

The idea of local currencies was first described by Silvio Gesell, in his book "The Natural Economic Order".

Only money that goes out of date like a newspaper, rots like potatoes, rusts like iron, evaporates like ether, is capable of standing the test as an instrument for the exchange of potatoes, newspapers, iron and ether.

Gesell also wrote an essay entitled "The Ascent of the West", which was written to challenge the cultural pessimism of Oswald Spengler's "The Decline of the West".

Gesell hoped that humanity would gradually be able to regenerate itself under a reformed economic order and experience a new cultural renaissance.

Its worth noting that local currencies did exist prior to the (literal) Renaissance before they were replaced with centralised currencies.

Centralized currency -- invented during the Renaissance, really -- favors the kinds of business practices and centralization of power that actually works against good, honest, local commerce. In short, it favors Wal-Mart over, say, Community Supported Agriculture.

There are other kinds of money – and they were in existence until they were outlawed by kings and queens looking to centralize authority. Money that is lent into existence by a central bank will tend towards scarcity and competition. Money that is earned into existence by people in a specific place has very different properties, and works on a model of abundance.

Gesell was a German theoretical economist who grew up in Europe, before moving to Argentina in 1887. A depression stuck Argentina shortly thereafter, which caused him to study the structural problems caused by the monetary system, before moving back to Europe in 1911.

His experiences during an economic crisis at that time in Argentina led Gesell to a viewpoint substantially at odds with the Marxist analysis of the social question: the exploitation of human labour does not have its origins in the private ownership of the means of production, but rather occurs primarily in the sphere of distribution due to structural defects in the monetary system. Like the ancient Greek philosopher Aristoteles, Gesell recognised money's contradictory dual role as a medium of exchange for facilitating economic activity on the one hand and as an instrument of power capable of dominating the market on the other hand. The starting point for Gesell's investigations was the following question: How could money's characteristics as a usurious instrument of power be overcome, without eliminating its positive qualities as a neutral medium of exchange ?

He attributed this market-dominating power to two fundamental characteristics of conventional money:

Firstly, money as a medium of demand is capable of being hoarded in contrast to human labor or goods and services on the supply side of the economic equation. It can be temporarily withheld from the market for speculative purposes without its holder being exposed to significant losses.

Secondly, money enjoys the advantage of superior liquidity to goods and services. In other words, it can be put into use at almost any time or place and so enjoys a flexibility of deployment similar to that of a joker in a card game.

These two characteristics of money give its holders a privileged position over the suppliers of goods and services. This is especially true for those who hold or control large amounts of money.

They can disrupt the dynamic flow of economic activity, of purchases and sales, savings and investment. This power enables the holders of money to demand the payment of interest as a reward for agreeing to refrain from speculative hoarding thereby allowing money to circulate in the economy.

This intrinsic power of money is not dependent on its actual hoarding, but rather on its potential to disrupt economic activity which enables it to extract a tribute in the form of interest in return for allowing the "metabolic exchange" of goods and services in the "social organism". The "return on capital" is accorded priority over broader economic considerations and production becomes attuned more to the monetary interest rate than to the real needs of human beings. Long-term positive interest rates of interest disturb the balance of profit and loss necessary for the decentralized self-regulation of markets. Gesell was of the opinion that this led to a dysfunction of the social system exhibiting very complex symptoms: the non-neutrality of interest-bearing money results in an inequitable distribution of income which no longer reflects actual differences in productivity. This in turn leads to a concentration of monetary as well as of non-monetary capital and therefore to the predominance of monopolistic structures in the economy.

Since it is the holders of money who ultimately decide whether it circulates or stands still, money can't flow "automatically" like blood in the human body. The circulation and the correct dosage of the monetary supply can't be brought under effective public control; deflationary and inflationary fluctuations of the general price level are inevitable. In the course of the business cycle when declining interest rates cause large amounts of money to be withheld from the market until the outlook for profitable investments improves, the result is economic stagnation and unemployment.

... to a Neutral Servant of Economic Activity

In order to deprive money of its power, Gesell did not advocate recourse to measures aimed at outlawing the taking of interest such as the canonical prohibition of medieval. On the contrary, he envisaged structural changes in the monetary system involving the imposition of carrying costs on the medium of exchange, thereby counteracting the tendency to hoard and neutralising the liquidity advantage of conventional money. The imposition of such carrying costs on liquid monetary assets - comparable to a demurrage fee for freight containers in the field of transport economics - would deprive money of its power to dominate the market while allowing it to fulfil its designated function as a medium of exchange facilitating economic activity. Counteracting disruptions in the circulation of the medium of exchange due to speculative hoarding would allow the quantity and velocity of the monetary supply to be periodically adjusted to match the volume of production and the overall level of economic activity in such a way that the purchasing power of the monetary unit could be made to possess the same long-term stability as other weights and measures.

In his earliest works Gesell referred in particular to "rusting bank notes" as a method for implementing an "organic reform" of the monetary system. Money which had hitherto been "dead foreign matter" with respect to both the social system and the natural world, would thus be integrated into the eternal cycle of life and death, becoming transitory and losing its characteristic of limitless self-multiplication by means of simple and compound interest. Such a reform of the monetary system would constitute a regulative holistic therapy; by removing the cause of disruptions in monetary circulation Gesell envisaged that the self-healing powers of the dysfunctional social "organism" would gradually increase allowing it to recover from the diverse economic and structural symptoms of crisis, ultimately reaching a state of equilibrium, in harmony with the rest of the natural order.

In his main work, Die Natürliche Wirtschaftsordnung durch Freiland und Freigeld (The Natural Economic Order through Free and and Free Money), published in Berlin and Bern in 1916, Gesell explained in detail how the supply and demand of capital would be balanced in the case of uninterrupted currency circulation so that a reduction of the real rate of interest below the presently existing barrier of around 3-4% would become possible. Gesell used the term "basic interest" (Urzins) to denote this pure monetary interest rate of around 3-4% which is found to vary little historically. It represents the tribute of the working people to the power of money and gives rise to levels of unearned income far in excess of that suggested by its magnitude. Gesell predicted that his proposed currency reform would gradually cause the "basic interest" component to disappear from the monetary loan rate leaving only a risk premium and an administrative charge to allow lending institutions to cover their costs. Fluctuations of the market rate of interest around a new equilibrium point close to zero would allow a more effectively decentralised channeling of savings into appropriate investments. Free Money (Freigeld), a medium of exchange liberated from the historical tribute of "basic interest", would be neutral in its impact on distribution and could no longer influence the nature and extent of production to the disadvantage of producers and consumers. Gesell envisaged that access to the complete proceeds of labour brought about by the elimination of "basic interest" would enable large sections of the population to give up wage- and salary-oriented employment and to work in a more autonomous manner in private and cooperative business organisations.

In 1919, Gesell was appointed "People's Representative for Finances" in the short-lived Bavarian Soviet Republic and immediately wrote a law for the creation of Freigeld. His term of office lasted only 7 days, and he was fortunate to escape a charge of treason after the overthrow of the Soviet Republic and its integration back into Germany.

Gesell's ideas spawned a political movement in Germany called "Freiwirtschaft" (Free Economy) party, which contested the 1932 elections without success. After the Nazi Party's seizure of power in 1933, many Free Economy supporters supported the new regime in the hope that Hitler might act on the earlier rhetoric of Gottfried Feder concerning "the smashing of interest-slavery". This proved to be a false hope and in the spring of 1934 the various Free Economy organisations which had not already voluntarily disbanded were finally outlawed.

Given the final destination of the pre-war Free Economy movement, I figured it was worth checking to see if Gesell held some of the more unpalatable views common to the time, such the "blood and soil" beliefs held by some of the greens that joined the Nazi "rogue coalition". It seems from this account that Gesell was no nationalist though, and explicitly rejected this line of thought.

Towards the end of the last century Gesell extended his vision of socio-economic reform to include reform of the system of land tenure. He derived inspiration in this respect from the work of the North-American land reformer Henry George (1839-1897), author of Progress and Poverty, whose ideas about a Single Tax on the rental value of land became known in Germany through the activity of land reformers like Michael Flurscheim (1844-1912) and Adolf Damaschke (1865-1935).

In contrast to Damaschke, who only advocated taxing the increase in values for the benefit of the community while retaining the principle of private ownership of land, Gesell's reform proposals followed those of Flurscheim who called for the transfer of land into public ownership, compensating the former owners and thereafter leasing the land for private use to the highest bidder. Gesell argued that as long as land remains a tradeable commodity and an object of speculative profit, the organic connection of human beings with the earth is disturbed.

In contrast to the proponents of nationalist or racially-oriented Blut und Boden ideologies, Gesell rejected the association of "blood" with "land". As a widely travelled citizen of the world he viewed the whole earth as an integral organ of every individual. All people should be free to travel over the surface of the earth without hinderance and settle anywhere regardless of their place of birth, color or religion. ...

From his earliest writings onwards Gesell distanced himself from racist ideologies, aiming to develop an objective critique of structural defects in the economic order free from the subjective racial prejudice of anti-Semitic demagogues whose diatribes against so-called "Jewish" usurers he criticised as a "colossal injustice". Like many of his contemporaries he was greatly influenced by Darwin's Theory of Evolution and viewed his program of reform as a means for encouraging a more healthy evolution of human society. However, Gesell should not be classified as a "Social Darwinist" because he believed that extremes of wealth and poverty reflect structural defects in the economic order rather than real differences in aptitude and productivity. Opposed to ultra-nationalist triumphalism he advocated the promotion of mutual understanding between Germany and its eastern and western neighbours. He called for the abandonment of expansionist politics and the formation of a voluntary confederation of European states to promote international cooperation. Gesell also drew up proposals for an international post-capitalist monetary order, advocating an open world market without capitalist monopolies, customs frontiers, trade protectionism and colonial conquest. In contrast to subsequently established institutions such as the International Monetary Fund and World Bank, which act on behalf of the powerful within the existing framework of unjust structures, or the present preparations for European Monetary Union, Gesell called for the establishment of an International Valuta Association, which would issue and manage a neutral international monetary unit freely convertible into the national currency units of the member states, operating in such a way that equitable international economic relations could be established on the basis of global free trade.

Gesell's political leanings seem to be best described as "individualist-mutualist". I like Robert Anton Wilson's explanation of individualist-mutualist theory, so I'll let him outline the idea and a few alternatives to Gesell's ideas regarding money. From "Left and Right: A Non-Euclidean Perspective ":

In the late '50s, I began to read widely in economic "science" (or speculation) again, a subject that had bored the bejesus out of me since I overthrew the Marxist Machine in my brain ten years earlier. I became fascinated with a number of alternatives - or "excluded middles" - that transcend the hackneyed debate between monopoly Capitalism and totalitarian Socialism. My favorite among these alternatives was, and to some extent still is, the individualist-mutualist anarchism of Proudhon, Jossiah Warren, S.P. Andrews, Lysander Spooner and Benjamin Tucker. I do not have a real Faith that this system would work out as well in practice as it sounds in theory, but as theory it still seems to me one of the best ideas I ever encountered.

This form of anarchism is called "individualist" because it regards the absolute liberty of the individual as a supreme goal to be attained; it is called "mutualist" because it believes such liberty can only be attained by a system of mutual consent, based on contracts that are to the advantage of all. In this Utopia, free competition and free cooperation are both encouraged; it is assumed persons and groups will decide to compete or to cooperate based on the concrete specifics of each case. (This appeals to my "existentialism" again, you see.)

Land monopolies are discouraged in individualist-mutualist anarchism by abolishing State laws granting ownership to those who neither occupy nor use the land; "ownership," it is predicted, will then only be contractually recognized where the "owner" actually occupies and used the land, but not where he charges "rent" to occupy or use it. The monopoly on currency, granted by the State, is also abolished, and any commune, group, syndicate, etc., can issue its own competing currency; it is claimed that this will drive interest down to approsximately zero. With rent at zero and interest near zero, it is argued that the alleged goal of socialism (abolition of exploitation) will be achieved by free contract, without coercion or totalitarian Statism.

That is, the individualist-mutualist model argues that the land and money monopolies are the "bugger factors" that prevent Free Enterprise from producing the marvelous results expected by Adam Smith. With land and money monopolies abolished, it is predicted that competition (where there is no existential motive for cooperation) and cooperation (where this is recognized as being to the advantage of all) will prevent other monopolies from arising.

Since monopolized police forces are notoriously graft-ridden and underlie the power of the state to bully and coerce, competing protection systems will be available in an individualist-mutualist system, You won't have to pay "taxes" to support a Protection Racket that is actually oppressing rather than protecting you. You will only pay dues, where you think it prudent, to protection agencies that actual perform a service you want and need. In general, every commune or syndicate will make its own rules of the game, but the mutualist-individualist tradition holds that, by experience, most communes will choose the systems that maximize liberty and minimize coercion.

Being wary of Correct Answer Machines, I also studied and have given much serious consideration to other "Utopian" socio-economic theories. I am still fond of the system of Henry George (in which no rent is allowed, but free enterprise is otherwise preserved); but I also like the ideas of Silvio Gesell (who would also abolish rent and all taxes but one--a demmurage tax on currency, which should theoretically abolish interest by a different gimmick than the competing currencies of the mutualists.)

I also see possible merit in the economics of C.H. Douglas, who invented the National Dividend--lately re-emergent, somewhat mutated, as Theobold's Guaranteed Annual Wage and/or Friedman's Negative Income Tax. And I am intrigued by the proposal of Pope Leo XIII that workers should own the majority of stock in their companies.

Most interesting of recent Utopias to me is that of Buckminster Fuller in which money is abolished, and computers manage the economy, programmed with a prime directive to _advantage_ all without _disadvantaging_ any -- the same goal sought by the mutualist system of basing society entirely on negotiated contract.

Further Reading:

* Bernard A. Lietaer - A Strategy for a Convertible Currency

* Shwarz, Fritz - The Experiment in Worgl

* Werner Onken - A Market Economy without Capitalism

* FEASTA - Money Systems

* Tim Boucher - Free (Online) Banking & The Free Banking Era

Cross-posted from Peak Energy.

Thanks Gav. Local currencies are seeing a resurgence here in Wisconsin. Fiat currency is fine as long as it is back by something real and that people have trust in it. One way to really get a local currency some momentum is to have local leaders persuade the utility company to accept the local currency as 5-10% of peoples electric bill. Then it reaches a tipping point of sorts.

On a related note, as bad as the financial crisis is, if you look at the world in terms of real capital (e.g. natural capital), the recent financial losses are dwarfed by 'monetary' losses in nature

Thats an amazing stat - Bucky Fuller had some interesting numbers regarding natural capital too (especially his valuation of barrels of oil, if memory serves me correctly).

It would be interesting to hear from everyone who knows of a local currency operating in their area - I couldn't find any sort of conclusive survey of the state of play globally, other than Evans-Pritchard's numbers for central Europe - but one guy I read cited a number north of 2000 (without any supporting data though).

For those inclined, please give this a vote on reddit too :

http://www.reddit.com/r/Economics/comments/76jfd/locabucks_are_local_cur...

Maybe we need a new global currency called, what else, "The Joule". I'll think I'll get to work and dust off my graphic arts skills and come up with a design.

Better. Tie the currency to BTU's.

No inflation. No indexing necessary.

No!

Just say no to funny units!

Use the kilowatt*hour as currency.

The kilowatt*hour is worth $0.10

The joule(electric) is worth $2.78E-08

The megajoule(electric) is worth $0.0278

The BTU(electric) is worth $2.93E-05

The thermal versions are worth even less, about a third.

Carnot efficiency dictates that the thermal unit is worth less than the electric one. An electric joule is almost directly equivalent to work, given that the efficiency of good motors is very high.

One must distinguish between electric and thermal units as in most applications thermal units have to be derated by a factor of about 3.

One exception is home heat. However, with a heat pump, thermal energy at a power plant is converted to thermal energy at the home at a 1:1 (or slightly better) ratio and electric energy from the power plant at a ratio of better than 3:1. So even for heating, an electric BTU/joule is worth more than a thermal one.

In transportation, the internal combustion engine has similar (worse actually) losses to the power plant and this situation is actually improved by converting to electricity first. Thus even for transportation, an electric BTU/joule is worth more than a thermal one.

One could argue an electric unit also slightly favors renewable energy (particularly wind) over fossil fuels, though in practice fossil fuel values would be simply be proportional to the average electricity they can be used to produce - and more efficient and less efficient conversion means would be very visibly rewarded and penalized as a plant that required 1.1 "KWH" of fossil fuels to make 1KWH of electricity would be at a disadvantage over one that could use 0.95KWH.

One catch, however, is that energy is likely to get more expensive thus providing positive interest for hording money if the currency notes aren't made to "rust". There would be one way obvious way to gain interest with a rusting energy currency: build a carbon free power plant. There would be others. Planting seeds. You spend todays money to be paid back in tommorrows. Probably any real investment (i.e. in actual production of energy or goods) would effectively yield "interest" as it would hold value over time. Fake financial "investments" would, at first glance, appear to lose value. Hoarded money would lose value. Hoarding fuel could be a problem.

To tie the currency to energy and yet have it rust requires stamps on bills and monthly penalties on bank accounts.

The selective inflation only when the currency is hoarded is an interesting idea. Retirement accounts for those already retired might need some special treatment (or be invested in energy production).

Ultimately, though, financial instruments (like stocks) might still work. You can buy stock in energy or food production. You can buy stock in other means of producing goods. And if that works, then derivatives will work. And who knows what kind of new contrivances will be developed and old ones will still work. There are a lot of other flaws in the economy that still aren't fixed. One could argue that the real estate disaster could still happen under such a system. Mortgages (even at 0%) returns money tomorrow in exchange for money today. Thus, it could be highly desirable as a way to hoard money, to the point of creating a bubble.

Money equals power and confers an ability to abuse that power to gain more money and power without extensive checks and balances. Just changing the flavor of money doesn't fix that.

I focused on the rust and energy basis in the above comment and ignored the local aspect and some others, indeed treating it as a national currency.

There was also some confusion about when and where the stamps where issued.

The local aspect has some interesting ramifications, some financial and others psychological.

First, lets look at the stamps. These are effectively a tax on money. Not a tax on earning money (income tax) or a tax on spending money (sales tax). In essence, this is equivalent to simply printing more money (straight inflation) each month. One difference is there is a hidden tax, that of the hassle of getting the money stamped which may have helped, beyond the inflationary aspect, in discouraging hording though end the end somebody was holding money at the end of the month and had to get it stamped. It isn't clear whether, if you failed to get the money stamped for, say, 3 months whether it was worthless or whether you had to buy three stamps.

Now, look at the 98% exchange rate to non-local currency. This encourages local consumption. An equivalent would be to tax non-local transactions (effectively an interstate or intercity commerce tax). In the US we have the opposite system. Local retail is taxed (sales tax) but interstate commerce can to some extent escape that (in states where they don't have offices). There are proposals to fix that with the original ones being objectionally onerous by requiring businesses to file returns with every state and now getting more reasonable in having a central clearinghouse. One could easily extend that regime to tax interstate commerce at a higher rate. There is also a non-governmental tax on interstate commerce - shipping cost/fuel but fuel has traditionally been at an artificially low cost. Assuming one had a interstate sales tax, a municipality could charge 2% less tax for local transactions; this could be justified in a revenue sense because since the money stays local they get to tax it again and again. But sales tax is still fundamentally different from a money tax. And one could argue that it was taxing money's existance rather than its movement (income tax from employment and sales tax from commerce) was the key aspect (or at least a significant one) that ultimately gave it velocity. Income tax, sales tax, capital gains tax, corporate income taxes all tax money for moving (something the flat tax people should take note of). Property tax is different in that it doesn't tax movement of money but taxes hoarding of certain tangible assets.

There is another aspect of a local currency: trust. The local currency was a fiat currency just as a national currency but its issuance was local. It rarely went very far out of your sight. Complicated contrivances like the stock market and arcane financial instruments that people don't really understand probably didn't exist for that currency and thus it was easier to understand and have confidence in and harder for people to charge money out of proportion to their services. Some of these complicated financial systems, however, do serve actual purposes.

The local currency was issued by the local government rather than being mostly issued by banks and was initially less leveraged (if you overlook the questionable stability of the national currency held as collateral).

The local currency was essentially facilitating a barter system. National currencies do this as well. If a local currency had not been issued, people would have had to resort to barter. The local currency provided a way to tax the barter system and use it for things like keeping government employees employed, aiding those who needed it most, and creating infrastructure (which ultimately creates wealth). Taxes on the money (within reason) is a small price to pay for the increased efficiency of barter. The government basically takes a percentage of the GDP gain and uses it for government services which is a win-win proposition.

The local currency was more likely to be embraced by those who did or could use local products, such as someone who made food products from local harvests. Thus it was easier to spend on local goods. And this lowered transportation costs and other parasitic costs. For every "dollar" spent on imports to your town, you probably see less money coming back for your exports. The further goods and money traveled, the more prone they would be to legitimate and illegitimate parasitic costs.

Ultimately, you do have to have interstate and international commerce. If you want to manufacture a wind turbine, for example, you need copper which will probably come from Chile. You need steel, concrete, and electronic components. If you want to install one, you need to buy a wind turbine that probably isn't going to be available from a local manufacturer. The local currency in this example allowed this, it just taxed it at 2%.

Both confidence in the local currency and lack of confidence may have contributed to its success. On the one hand, one could be reasonably confident that if you accepted the currency today for goods or services you could immediately turn around and spend it. On the other hand, there was less confidence you could spend it tomorrow. You were guaranteed that it would be worth less next month (and this was perhaps more psychologically apparent than inflation) and it might be worth nothing tomorrow or in a few days. Thus it was a hot potato. You were better off spending it on something you needed, or at least had intrinsic barter value, than holding it but you were better off holding it or exchanging it for something tangible than to buy something of little value. So, maybe they hit on the right balance of confidence.

Hoarding of goods may have been significant but at least that kept the money in circulation and the economy running (though it could lead to resource shortages). And as long as the money is circulating there is some confidence. In a depression, there isn't (necessarily) a shortage of materials or labor, there is just a failure of the economic system. People still need goods and services and need the jobs that producing those entail.

Thus, a couple key aspects that are different than our current economy seem to have been that money was taxed rather than the movement of money and that non-local commerce was taxed. The first aspect is similar to inflation but inflation is the result of governments printing money out of proportion to the growth of productivity - which is ok if you spend it on infrastructure that causes productivity to grow.

At the very least, energy dollars could provide a way to help keep the electric on. They utility could pay their workers in energy coupons which could be traded for things the workers need to live with people who then use those coupons for trade or to reduce their electric bills. Additional money is still needed for fuel, but people have an easier time coming up with the reduced amount of money if they can grow food in their garden or rent a room in exchange for energy coupons.

Outstanding. I like thinking of electric coupons as dollars,

BTU notes as, then, a lesser amount, then.

But electricity(value added) is less fungible as a "commodity" that would be

paid as the coupons/notes were turned into the "Treasury"

for redemption.

Sincerely yours,

James

The technocracy movement has had that same idea.

The benefit of 'watts' would be a destroyable currency. But they are not storable - thus a poor choice for currency.

but isn't that the point

surely a currencey that was backed by the reality of depletion and finite non renewable and/or fixed traffic flows of renewable energy is eaxctly what we need?

What is meant by backing here? In order to backup a currency in my meaning of the word, a currency backed by "x" means you can use the currency, reliably, to buy "x". Backing with gold when you don't have gold is meaningless. Backing with energy when you don't have energy, likewise. I've made a theoretical proposal that if the government nationalized geothermal energy, developed it and then had a supply of it, you could have an energy-backed national currency. It won't be done and probably a good thing since to be benign we would have to have national governments that acted in the public interest. Transition to such a type of governance is problematical. So now we have a currency theoretically backed by the government's ability to tax its citizens and require those taxes be paid in its currency. In the midst of astonishing levels of government debt and needs to create more one of the few things our presidential candidates agree on is the need to cut taxes. True, McCain would cut taxes on the rich and Obama on the poor, but cutting taxes is not disputed. McCain's strategy has a current difficulty. A great many people who were expecting to get rich soon (or sometime) are now beginning to worry just a bit about becoming poor. Losing your house, your job, your health insurance can do that to you. Even if it just happens to a friend or a brother-in-law, it can concentrate the mind as they say.

Having the local currency "backed" by the city government (as described in the article) seems to be a key factor because then it is ALL the citizens money to exchange and not just the experiment of a small subset of the citizens.

If local taxes, utilities, newspaper service, school fees, public transit, taxi service, hospital fees, and other economic interactions that the WHOLE community participates in will also accept the local currency (at least as partial payment) then the local currency could easily replace a decent percentage of the national currency that swirls amongst a community.

But I don't quite understand all the details behind the stamps...

It sounds like you would take your local currency "somewhere" each month to get it stamped, and that the stamp was some percentage of the face value (like 2 cents per buck).

But where and who is that "somewhere"?

What is the stamp fee used for?

What happens when all the spaces are stamped? Is the buck retired or replaced?

How is additional currency added to the system?

(the article says that a deposit of city funds backed up the original issue of bucks - perhaps more funds had to be deposited - perhaps the stamp fees were used)

I'm sorry, but as long as the local currency is still backed by nothing but will of the local government aka fiat. It is still as bad as the national currency, and shares the same fate. It just has not gotten there yet.

it would be much simpler if the currency is backed by something that is hard to acquire or horde, like say human labor. for example 1 local buck is exchangeable for 1 hour of human labor.

Backing it with something as vague as an hour of labor seems to be a sure path to failure - just because nobody can agree on the value of that mysterious hour (such as "My hour of fixing you plumbing is more valuable than your hour of babysitting my kid"

Having it backed with something seems important though. Which is why I think the Austrian city was so successful after backing it with their savings account.

And let's not forget, an hour from Lazy Larry the plumber may not be worth as much as an hour from Hardwork Harry the plumber.

One of the repeated failure modes of local currencies is trying to use them to accomplish goals beyond what they are suited for. Having them backed by hours of labor is often seen as a way of having a more equitable society. (My hour is worth just as much as yours!) I think there are lots of reasons for making things more equal in certain ways, but trying to do it via a time based currency means the currency will have very limited use at best.

But your hour is definitely not worth as much as mine, for suitable values of you and me.

Differential pay serves a very good purpose when the differential is actually based on merit (or, in some cases other values like risk). The problem isn't that pay differentials exist it is that the market values of people's work have been badly distorted. When people are paid based on what they actually contribute (or could contribute, if they had money) to the economy, then it facilitates putting resources in the right hands, encourages education, etc.

Equal value of labor can work to a very limited extent when it is a small part of the overall economy. A doctor may occasionally take "your" hour sweeping his floor at home as trade for an hour of medical service because he is no more productive while sweeping the floor than you are (in some cases even less) but he is better off spending 15 minutes with a paying patient and using that to hire a maid. But he can't pay for medical school, an office, staff, equipment, etc. doing this full time. Thus, 3/4 of the doctors time is charity, not barter.

Ok, in some cases doctors are way overpaid but in other cases they are not. But one hour of good janitorial service isn't worth an hour of good medical service, any way you slice it.

A good engineer's services are worth more than a good technician's services. A good technicians services are worth more than a good short order cook's services. And a good short order cook's services are worth more than a bad short order cook's services.

Consider what two different able-bodied people can do without interacting with the economy. With the same resources (land, trees, basic tools, access to a library, etc.), one person may be able to build a large log cabin, and grow more than enough food for himself and another may manage a structurally unsound shack and barely enough food to survive, if that. Their labor isn't equal. An economy should allow both to do better, through efficiency, economy of scale, and allowing people to take advantage of their strengths and let someone else fill in for their weaknesses, than either can do by themselves, not drag one person down to the other person's level. If you assign equal value to everyones work, you either drag A down to B's level or deny B access to A's services entirely.

All that is quite obvious to some of us yet basing local currencies that way retains popularity, unfortunately.

I have the same questions as you. I hope someone will answer them. However, if all you had to do to keep your currency valuable was to take it somewhere to get stamped, then that would not prevent hoarding. If the banks issued the stamps, then the banks would be free to hoard. If the gov issues the stamps on money paid to it, then it would seem that the government would inevitably grow and grow in order to keep the velocity of money moving fast enough for a growing economy.

Money is a symbol of value. Whether it be gold, paper or kauri shells, money represents value, it has no value of itself, when used as money.

If money has to represent the value of what is available to a community, a depreciating currency is exactly right : everything else depreciates, so money should too.

In any case, as things go, money has become largely virtual : tens and hundreds of trillions of dollars have been reported as composing the volume of CDO's, CDS's and other debt derivatives. The amount of money owed no longer fits to the amount of life produced, consequently, lots of people will have miserable lives, and some happy few will go on quite comfortably, even as they frown more often.

I think a depreciating currency is the best idea since the wheel, baked bread and beer.

"It sounds like you would take your local currency "somewhere" each month to get it stamped, and that the stamp was some percentage of the face value (like 2 cents per buck).But where and who is that "somewhere"?"

The local council offices.

The shilling was issued by them, and but for the shilling to be legal tender it had to have a current stamp on it, a stamp of this month. This stamp cost 0.01 shilling.

Because the money lost value each month, this encouraged people to spend it quickly. Thus demand for goods and services was stimulated, and supply rose to meet it - ie the local economy grew.

"What is the stamp fee used for?"

The same thing council fees are used for nowadays - to pay council employees, fund works and so on.

"What happens when all the spaces are stamped? Is the buck retired or replaced?"

It's replaced - at a cost of 1% of its value.

"How is additional currency added to the system?"

By printing more. Just like regular currency.

"(the article says that a deposit of city funds backed up the original issue of bucks - perhaps more funds had to be deposited - perhaps the stamp fees were used)"

Nowadays, currency is created by debts. Someone deposits $1 million in the bank, the bank can now lend out $1 million, provided the depositor doesn't expect to withdraw their money tomorrow. In practice banks have thousands of depositors, it's unlikely they'll all withdraw their deposits tomorrow at the same time, so the bank can lend out that $1 million - in fact they can lend out even more, $10 million in total.

Obviously banks can get carried away with this, so the law sets down a reserve requirement, how much do they have to have in deposits compared to how much they lend out - historically this varies between 1% and 10%; that is, for every $1 on deposit, they can lend out $10 to $100. This fractional reserve requirement is an important thing.

Worgl, likewise, had a fractional reserve requirement, but it began as 100% - they could issue no more local currency than they had national currency.

It thus looks like they were effectively doubling the currency they had available, so we'd expect a doubling of the government part of the economy (road-building, etc). But in practice it had a greater effect. That's because the money didn't sit still, but circulated quickly within the system.

If someone got paid 100 local shillings for his day's labouring work on 20th August, he knew that on 1st September it'd become effectively 99 local shillings. So he went and spent it on (say) a 100 shilling suit. Then the tailor on the 21st August took the 100 shillings and bought (say) a guitar for his son's birthday. Then the guitar owner took the 100 shillings on the 22nd and bought (say) a week's groceries. Then the grocery shop owner took his 100 shilling on the 23rd and used it to hire the labourer for a week.

Thus, because the money circulates quickly, it stimulates a lot of activity. The 100 shillings of cash brought out two weeks of work from the labourer, one suit, a guitar, and a week's groceries.

That's the thing about money. The total amount there is doesn't mean much in terms of productive activity. What matters is how much it circulates around. So that 100 households earning $10,000 each do a lot more in terms of stimulating productive activity than 1 household earning $1 million. The 100 poor households spend all their money, and quickly; the 1 rich household will hold onto a lot of their money.

Money is the blood of the economic body; it must circulate freely, not be clotted up, in order to keep the body lively.

Geoff Davies talks about this a lot in his book Economia, which I recommend for a very good and clear description of the way money works.

What an excellent insight! Completely true! There are also water losses and arable land losses, fishery losses, etc. It adds up. Since all currency has one foot in nature, this represents a real loss in corresponding money value. this must be compensated for by increasing the quantity of money in proportion ... to its unit decrease in value.

From the value viewpoint, the amount of interest to be gained by putting it into use is marginal (as is its taxability, which is now irrelevant). It is difficult to make the marginal the entire focus of what a practical economy can produce or consume; this can only be done by greatly expanding the quantity of money in use and making speculation tools available that have nothing to do with production yet magnify yield, or return on money lent.

Respectfully disagreeing with the original Big Gav post, I believe the benefits of yield far outweigh the costs. There is a prejudice against yield, since most people connect 'interest' with 'expense' as most people are borrowers, they are compelled by advertising of circumstance to be so. The 'interest earned' aspect of money is more important, because it is a human component that can be added to the nature ocmponent, it allows for the accumulation of cash-money or 'specie' wealth, which in turn becomes the capital basis for more investments. The alternative to base capital on ever- encreasing more cheaply available credit ... which indeed centralizes economic power and places dangerous emphasis on money velocity.

Many of the characteristics of de- centralized or 'niche' money have been usurped to a large degree by modern currencies, mainly the loss of yield or the return on money at both the local and macro level. This is perhaps not an issue in smaller spheres where the difference between a 'demurrage charge' and interest returned would be small, but on a national level, the loss of yield has had the consequence of turning a nation of thrifty (and conservative) savers into a nation of (currently) dismayed savers and a small, but influential group of wild speculators.

It is confusing to view central bank money in the context of the liquidity breakdown; it's easier to examine the pre-crash circumstances. There hasn't been a money monopoly or a 'money hoarding blackmail system' but the wide availability of cheap credit. Since it earns little, any return must be earned by volume of lending and turnover. This process requires in an excess of liquidity; the sum of many loans piled on top of each other each earning a very small amount. The leverage to return ratio has been magnified; money has been accumulated, but the accompanying risk has been accumulated as well. The resulting 'wealthism' - having the appearance of money (hoarding) wealth while actually being insolvent and over leveraged - has propelled us into our current dire circumstance.

A well managed centralized fiat money system is a great benefit to all citizens which creates a general and widespread sustainable prosperity. Unfortunately, I cannot think of a practical example of such a system ...

A 'local currency' of note is the Icelandic Krona. It wasn't outlawed, simply speculated out of existence. Any successful local currency would suffer the same fate, unfortunately. 'Successful' means having the wealth- carrying characteristics of specie/coin beyond a very small area or group of people. Since this is a negative feedback loop, it limits the utility of any 'niche' currency.

On the other hand ... A more familiar form of niche currency is coupons. Coupon issuance may be a way that otherwise obsolete businesses like airlines and 'home improvement centers' may stay in business. If one can use Home Depot coupons to pay the gas bill ... and Home Depot can charge 10% a year ... that would probably keep them in business. Home Depot has sufficient capital to fend off speculators (it's bigger and more conservative than Iceland) and a legal team that could stave off the Treasury in the courts.

The Home Depot National Bank. What a nightmare!

steve writes: "I believe the benefits of yield far outweigh the costs. There is a prejudice against yield, since most people connect 'interest' with 'expense' as most people are borrowers, they are compelled by advertising of circumstance to be so. The 'interest earned' aspect of money is more important, because it is a human component that can be added to the nature ocmponent, it allows for the accumulation of cash-money or 'specie' wealth, which in turn becomes the capital basis for more investments."

Steve — the main objection to interest currently is that it fuels perpetual economic growth, which is responsible for bringing humanity to the brink of global resource depletion. The money to pay back the interest has to come from somewhere, and it comes from monetizing natural resources and cannibalizing productive human resources in the form of bankruptcies, foreclosures, etc.

"...but on a national level, the loss of yield has had the consequence of turning a nation of thrifty (and conservative) savers into a nation of (currently) dismayed savers and a small, but influential group of wild speculators."

That's interesting, do you have an example of demurrage currency that has been used on a large scale? It is very true that what works at a local level can't always be implemented successfully at national levels. I'm also not sure I understand what would motivate speculation in a demurrage currency system. It seems like it's guaranteed loss of value would mean there's nothing to speculate... the only choice it provides, really, is to trade it for something that depreciates less rapidly.

Any successful local currency would suffer the same fate, unfortunately. 'Successful' means having the wealth- carrying characteristics of specie/coin beyond a very small area or group of people. Since this is a negative feedback loop, it limits the utility of any 'niche' currency.

Local currencies are designed to maintain wealth circulation within a geographic area and not beyond. They are supposed to act as a barrier against wealth drainage out of the area.

One last note... can you explain the Home Depot gas bill scheme in more detail? I'm not following how that would work.

Thank you, I appreciate the conversation.

In theory, this is true, but in actuality, the opposite happens. First of all, resource depletion is an outcome of population growth and social mis-management rather than money or interest rate policy. An example would be the Anasazi or Maya peoples who had (as far as I can tell) no monetary policy but did strip their resource bases to nothing. In the competition for money in a low- yield environment, the irresponsible have an unfair advantage as they can promise greater yields and deliver same when circumstances are favorable.

When there is large liquidity the returns from interest are small. Largely, this is a function of supply and demand. Despite the apperance of exponential yields accumulating to monstrous amounts, in reality, the pressing down of interest rates by central bank market activites and by bank securiization strategies makes these kinds of returns impossible. One only has to compare saving and interest rates since 1982 to see that there has been no money to be made by saving. So ... people don't do it! The only savings activity taking place in the US currently is subsidised as in 401k retirement plans and most of these plans involve speculation in the asset and debt makets.

Secondly, for most classes including the most productive middle classes, there has been (since 1992) little or no actual productive economic growth that cannot be attributed to general population increase. The vast majority of Americans have had little return on either skills, education certainly not on savings. Growth for the past few years in the USA has been a atatistical anomaly that measures the 'action' in financial casinos as growth, consumption from overseas production as growth, inflation as growth. Yes, the money system monetizes natural resources (and fails to monetize others) but it monetizes itself much more profitably since there is no theoretical limit to such monetization. Resources tend to orbit near their utility; financial instruments are abstract, with no utility other than their power to compel, they are advertizing media for themselves.

Thirdly, the outcomes of bankruptcies and foreclosures is a the natural outcome of speculation because speculation multipies risk exposure as it multiplies it chances for yield. Eventually, risk cannot be contained ... In the West, the 'single function' currency allows non-productive speculative claims to be made against productive parts of economies. This is a serious flaw in the single function regime. Now, the question is it possible to have an economic system that is infinite (has infinite money supply growth and therefore allows unlimited opportunities for speculation) and the answer is obviously 'yes'. Whether this kind of economy could operate safely alongside one that involves actual production is hard to answer. Today, the answer is obviously no, because of the single function currency.

A serious examination of simultaneous currencies (eliminating uniform currency functions) has never been made to my knowledge by mainstream economists.

Up until recently, the US dollar! Its rate of depreciation was not printed on it, but it has been common knowledge (that knowledge serving the same purpose) that it loses (or lost or will lose) value at a faily high rate over time. The best thing to do with a dollar is get rid of it - spend it! Now this issue of speculation vs. savings is important.

You are right, and depreciation is the mother of invention! In any system, there will be a demand for yield; to earn money without toil, to earn for descendents, to earn for a rainy day. The result is a 'race' between the rate of depreciation (demurrage) on one hand, and what can be gained by using this depreciating 'money' as collateral in a speculative environment. An example is the (late, lamented) Icelandic Krona. This money was used as basis by the three large Icelandic banks to leverage speculative lending in currencies other than the Krona. This speculation had the effect of depressing the value of the Krona further, which required more leverage by the banks upon it to keep pace - the continued depreciation (demurrage) of the Krona itself beoming the risk in the regime.

These banks made every sort of loan to anyone upright around the world in the hunt for yield. The initial result was an influx of speculative returns that allowed the Icelanders to build ugly houses, drive giant SUV's, wear 'luxury shoes' and carry 'luxury handbags' -sounds familiar? When the speculations became unfundable, the 'demurrage risk' of the Krona accelerated past the rate that ANY speculation would support. The result was bankruptcy of the whole country.

Ths US ought to use some of the bailout money and buy Iceland, I'm dead serious! It would cost a couple hundred billion dollars to buy the banks, the banks' troubled assets, all the depreciated Krona and the country's obligations. Iceland, the 51st State!

This is the key to any demurrage regime; if the rate of depreciation is high enough to thwart speculation it would be so high as to render the currency valueless!

Consider Gresham's Law, which governs this sort of activity. The bad (the niche currency) drives out the good (the national currency). While the niche currency in a small town in Austria did not leave a speculative footprint like Iceland's, it certainly attracted speculation, as circumstances allowed its tendencies to become well known. There would have been a 'black money market' trading the local currency against the government bills which would have depreciated one currency against the other. Eventually, this speculation would have forced a 'run' on the niche money which would have eliminated the town's 'reserve' of government cash ... that being the goal of the black money market operators in the first place.

In other words, the long term issue with any niche currency is to be just bad enough ... but, to keep from becoming 'terrible', where the next step is worthlessness.

This presupposes wealth exists in an area to begin with. Wealth is the accumulation of capital and without yield capital dissipates. Everyone in the World is living this right now! Niche currencies that exist within dominant currencies are reactions to deflation and the tendency to hoard; where there is little commerce to earn a fraction from - there is no yield, in other words. Where there is no yield, there is no wealth to conserve. In such a state, the niche currency is a 'wealth substitute'. The Worgl experiment WAS actually a good example of a well- run fractional- reserve- lending fiat regime ... :) An opposite exmaple is Haiti, which would have little wealth regardless of what form it currencies took.

Some things to keep in mind:

The dual currency idea is one I've had for a long time; one 'hard money' convertible 'Gold Dollars' that would be useful for saving and productive investment and a second 'fiat money' non- convertible (electronic) currency that would be used for financial speculation. (I had this idea as a way to eliminate the drug trade as the fiat regime equates currently worthless paper money with a transient drug 'high', convertible cash would be too valuable to waste on drugs but would be hoarded, instead.) Compounded yield on savings would be varied to keep enough Gold Dollars in circulation for day to day use and to finance improvements. In this regime, the Gold Dollars would be convertible, to gold or other precious metals and be resource- based. The Gold Dollars would not be useful for speculation because they would be generally unavailable and would cost too much; the yield on simple bank savings would be greater on a risk-adjusted basis than would speculation - there would be little reason to speculate. Gold Dollars would be the currency of the fiscally conservative and thrifty.

The other dollar currency would be zero- or negative yield fiat money (printing press money) that would only surrender yield to speculations. While some speculations would undoubtedly involve resource recovery (which is inevitable, under any regime) the natural volatility of the speculative environment would tend to keep recovery programs in the 'Gold Dollar' ambit where the poorly thought- out schemes would be wisely unfunded.

Speculators would embrace the fiat dollars because they would invariably allow certain speculators to become fabulously rich, (but not all of them, which is the purpose of speculation in the first and last place and is the case now).

The returns in fiat currency could (and would certainly) be converted to hard currency by buying gold or land, or by buying watershed easements or returning land out of suburban developmnt to open space ... or replacing carbon sources ... by husbanding the resource basis for the Gold Dollar. Here, the bad money would drive out the good ... but the good would have someplace to go! The 'high yielding safe haven' would therefore increase; a haven for all capital during speculative crashes and a place for credit capital to manifest itself as real wealth in times when speculation is successful.

All taxation and government spending would rest upon the fiat regimes' earnings as is the case now; speculation would be encouraged by the government for its own reasons, yet bailouts would be unnecessary as a new class of speculators would continually arise to take the place of the bankrupts. In the dual currency regime, the problems would always rest with the participants rather than with the system itself. There would be 'black markets' (and these encouraged) to arbitrage between the sectors but the periodic crashes of the fiat regime would put these out of business before they could harm the hard money sector. The Gold Dollar regime and the fiat regime would exist side by side with the firewall between.

Home Depot would simply print its own currency but it would be in the familiar form of coupons. The inflator would be collected from all costomers at the cash register, (whether they used the coupons or not) so there would be no 'inflator upon the coupon' as with the demurrage example. Home Depot's coupons would be convertible against their stock value + cash on hand + good will + a percentage of available credit; this would be strictly a fiat regime. Using a conservative 'float' HD could print a couple billion in Home Depot Dollars that would used in place of US dollars, although it is likely all that liquidity would not be accessed.

This would substitute for liquidity that is currently trapped in banks and finance houses; it would insure Home Depot had a steady stream of 'customers' (some would only buy coupons ... with US dollars) and the other businesses would have an additional source of liquidity; derived from those dollars held by Home Depot. Customers bringing US dollars as well as coupons would generate sufficient cash flow for Home Depot that it could operate with less credit exposure while expanding its 'fractional lending' of Home Depot Dollars.

The challenge would be for Home Depot's suppliers to accept its coupons as promissory notes against eventual repayment in US Dollars. If effective Fed/Treasury credit evaporates, it might be the only atlernative for all concerned. People will hate Home Depot less or will hate it for different reasons than they do now, but the business will survive. (Putting a 5Mw wind turbine @ every store would help them survive, too!)

I believe that an effective local currency would be helped by distinguishing between the functions of medium of exchange and store of value. In truth, in my private definition of money we already have (or had) such a system where Federal Reserve stuff was our trading currency and Treasury paper was our store of value currency. Such local currencies as LETS can be redesigned as effective trading currencies. In LETS there are positive and negative balances within the system. Put an interest charge on both of them since they provide a service to both parties. That will encourage people to not hold onto their balances but use them in trading. Provide a means to convert a LETS balance into and out of the national currency from where it can be directed to some means of storing value. I believe that interest on both types of balances was suggested by Keynes for the IMF. His best ideas got ignored.

You're hired!

Gresham's Law works with Keynes' ideas as well, the bad far outweigh the good. His tendency to borrow and lend while suspending disbelief at the same time simply drives interest rates down (since the borrower's advantage increases as he continues to borrow). This is one reason why we are in the terrible mess we are in today.

That ... and in the long run, we are all dead!

Oh, please, let's not be silly about this. One such is called the US dollar, especially as it existed from about 1971 to 1982. For ordinary citizens, the practical effect of having inflation far exceed government-limited savings account rates was identical to the practical effect of demurrage. The Baby Boomers learned not to save and invest, but instead, to borrow as much as possible (below the inflation rate) to "own" as big a house as possible (above the inflation rate.) The lesson seems to have become deeply and permanently ingrained, and it seems to be the biggest factor at the root of the current mess. (The next-biggest factor seems to be a touching but foolish faith that averaging together a bunch of worthless mortgages to form "securities" can magically remove systemic or correlated risk. This may have arisen when the finance industry got into the habit of hiring failed physicists to play at maths. Alas, the failed physicists chose to forget that averaging only reduces risk (or variance) with respect to uncorrelated random variables. And corrupt Congresscritters who sought votes by promising free palaces all around were only too happy to go along.)

The stamp feature (demurrage) of the Wörgl currency amounted in practice to a huge effective annual inflation rate. I'm not (yet) seeing desperation on any scale even remotely approaching what occurred in 1937 Wörgl; indeed the roads here in Wisconsin seem to be about as busy as ever with evening and weekend discretionary travel. So why in the world would any sane person accept vanishing locabucks in lieu of comparatively hard "real" currency? If the locabucks are convertible, then exchange charges or demurrage simply represent a deadweight cost, so why bother? If not, then why take a chance on being stuck when you need something that can't be produced casually by somebody puttering in their backyard, such as an antibiotic?

More broadly, "we" created the current mess by insisting that our Congresscritters should make life more "fair" by providing instant gratification in the form of quasi-free houses (via interest-only liar loans ultimately made possible because Fannie, Freddie, and Ginnie injected outrageous quantities of surplus money into the "markets" over the years) for people who could never conceivably afford to keep them up. How could we possibly expect that locking in an already runaway free-spending instant-gratification meme even more tightly could ever help us with such fundamentals?

[Edit] The comment above about Lazy Larry and Hardwork Harry also reminds me that social-engineering schemes of this sort are often little more than ways to provide undeserved subsidy hammocks for the Lazy Larries of the world to lounge in at other people's expense. A major reason many local business have gone under over the last few decades is that they provided poor value for money and could not withstand the slightest whiff of competition. Good riddance. (And don't tell me trade over distance is going to cease tomorrow morning. For one thing, relying exclusively on local food, which is subject to the vagaries of the weather, would be a sure recipe for death; and for another, even the ancient Greeks shipped grain, which has always had a fairly poor value-to-bulk ratio, many many hundreds of miles.)

A timely topic for me; this afternoon I was reading Chapter 9: Energy and Economics of Odum's "Environment, Power and Society". It addresses many of the issues in this thread. One of my marginal notes - nature never gets paid. The annual cost of forest loss - $2 to $5T. The annual cost of species extinction is probably many orders of magnitude greater than that (separating out a forest of Loofla trees from the LAST Loofla tree). The destruction of a species - say Atlantic Salmon here in Maine - is enormous compared to the few dams on the river that are causing that destruction. Gigazillions of watts of sunlight evolved that salmon over a next to forever time period and the State of Maine decided to exterminate the species for the benefit of a few dollars for FPL. Gaia's emergy investment in the salmon species - its genome, ecological niches, etc... - we don't recognize outside of the price for a few pounds of fish flesh. And we say we can substitute that with farm raised tilapia.

I love stuff like this in the text - and I don't yet understand how Odum gets to this point:

and

I read that to mean "the more money we add to the mix, the more activity". The Worgl effort shows that too. But the horizons were different. Worgl scrip stayed in Worgl and environmental destruction would have been seen; so they planted forests. Dollars chew up forests out of sight. That's a qualitative difference.

Odum suggests not a currency based on joules or btus, but on "emergy". The first (or last) copy of a book will cost far more than the equivalent weight of paper. Though if there are very many in circulation, it might be very close. He refers to the "wealth buying power of money" as an "emergy certificate", not an "energy certificate". [The Last Salmon vs pounds of generic fish]

Another thing about this money discussion. People need to be able to live with both feet in the local scrip paradigm. Cherry picking doesn't work.

cfm in Gray, ME

Odum suggests not a currency based on joules or btus, but on "emergy".

And part of the eMemrgy plan is a value to the 'mental work' going into the production of, say, a solar cell or a fission power plant.

Does anyone know of a good de-construction of this part of Odum's work?

Gav - also, given our penchant to need a 'smoking gun' before changing conventional wisdom, perhaps Australian communities will have more luck initiating local currency movements, because the 'example' of losing purchasing power is fresh in their mind. Aussie dollar has lost 1/3 of its value in last few months (at least againt US$ -more against Yen, less against Euro).

If people suddenly have to pay more to get goods on international market, and are uncertain about future of their national currency, awareness that their localbucks can be exchanged for food and barter items with people they live near and come in contact with everyday might become more attractive - or at least less wild sounding.

The fall has been staggering, but hasn't shown up in prices yet (at least as far as I'm aware) as it has happened so fast.