A Visit To Malaysia

Posted by Big Gav on August 3, 2008 - 12:27pm in The Oil Drum: Australia/New Zealand

I spent a week in Malaysia back in June, loafing about in the sun on the island of Langkawi. While I mostly tried to ignore the news flow, I did read the local paper each day and there seemed to be plenty of energy related stories on the boil. These ranged from prominent exposure of the global "energy and food crises" to more locally focused issues, which I'll take a look at in this post.

Tourism

Tourism is Malaysia's third largest foreign exchange earner after manufactured goods and palm oil, so rising fuel prices are likely to crimp the local economy (although palm oil exports would seem likely to offset the impact on the other 2 sectors).

This was borne out anecdotally during my visit, as the resort driver who took us to the airport at the end of our visit noted that off season was much quieter than normal, with a occupancy rate of around 30% compared to the usual 50%, which he blamed on the rising price of oil. This doesn't seem to be reflected in overall visitor numbers so far though, so perhaps it is just the higher-end resorts that are being impacted so far.

As taxi drivers go he seemed remarkably well-informed about energy issues, following this opening gambit with a long line of questions about my opinion of the future of oil prices, the pros and cons of using LPG / CNG fuelled cars vs electric cars, what energy sources Australia used to generate electricity, how much fossil fuel we export and the impact of the Australian drought on rice prices.

Oil Production

Malaysian oil reserves, believed to be around 4 billion barrels, are estimated to last less than 20 years at the current rate of production. The country is now widely assumed to now be past peak. The country is still a net oil exporter, however there has been speculation that this may end as soon as 2011, becoming yet another example of the "export land" phenomenon.

The EIA forecasts that Malaysia’s oil production will fall to 693,000 bbl/d in 2008, a 13 percent decrease from 2006 levels. Most new oil fields are located offshore. Recent finds have largely been off Sabah state on the island of Borneo, with 26 deepwater fields discovered since Murphy Oil discovered the Kikeh field in 2002. Seven of these fields are slated for development over 2008 to 2012. For the time being, these new fields are compensating for the depletion of existing fields, with production rebounding somewhat recently.

Oil represents around 10% of Malaysia's export income.

Peak oil wasn't mentioned in the local press during my visit, though Shell was doing a roadshow of their latest scenario planning output - Blueprints or the Scramble.

Petronas

Petronas is Malaysia's national oil company - wholly owned by the government and reporting directly to the Prime Minster (not Parliament). It ranks in the top 100 corporations globally, is the 8th most profitable in the world and the most profitable in Asia.

Petronas' oil income has enabled the Malaysian government to fund all sorts of grand experiments, from the famous Petronas Towers in Kuala Lumpur to paying for Malaysian astronauts to go into space as passengers on Russian expeditions - some of this expenditure has come in for criticism from people concerned that this dwindling income stream could be put to better uses and is often being wasted.

This criticism has increased in recent months, as Petronas' soaring income has been matched by cuts to government fuel subsidies, resulting in a 40% jump in the price of fuel (though it is still cheap enough for smugglers to try to arbitrage the price difference between Malaysia and Thailand it seems, judging by the local press) and sparking protests across the country.

The government has responded to the unrest by offering a special dividend to "ease the people's burden".

The company is trying to adapt to declining discoveries in its home market by expanding abroad in a variety of locations, including Myanmar, Russia, Mauritania, South Africa, Sudan and Iran.

Palm Oil And Food Prices

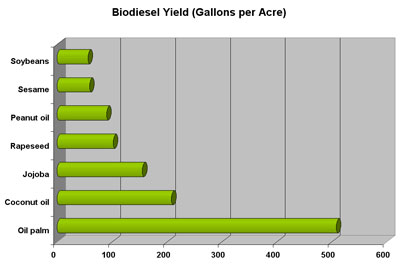

Malaysia is one of the world's largest producers of palm oil - an important feedstock for biodiesel production.

The price of palm oil has soared in recent years, from around 1200 ringgit per ton to almost 4000 ringgit per ton - only recently sinking back to the 3000 ringgit per ton mark.

Oil palm cultivation uses 67 percent of Malaysia's agricultural land, and around 500,000 people work in the industry. The country expects palm oil production will hit 20 million tonnes by 2020.

There has been concern expressed locally as well as internationally about the impact on food prices of using palm oil for fuel instead of for cooking. There are also concerns that continued expansion of oil palm cultivation will mean extinction for the orang utan.

During the mild panic that erupted over rising rice prices in the first half of the year, the Malaysian government threatened to start bartering palm oil for rice, bypassing international commodity markets entirely.

Gas Prices And Rubber Gloves

Rubber prices have soared in recent years, with rubber plantations now expanding rapidly as a result, sometimes at the expense of palm oil plantations.

My energy enthusiast taxi driver noted that this has been positive for rubber farmers like his father, who are frequently small holders and traditionally had a difficult and lowly paid job. Apparently over the past decade incomes for these farmers have increased 10 fold, from something like $30 per month to $300 per month (no - you won't get rich becoming a rubber farmer).

Gas prices have also risen sharply, amplified by cuts to government subsidies.

The combination of these two factors has meant trouble for rubber glove manufacturers, who use both rubber and gas in glove production. One Malaysian business, Kossan, is the world's third largest glove manufacturer - producing 12 billion items per year - with gas comprising the bulk of production costs. Another Malaysian producer, Top Gloves, is the world number one, producing 30 billion gloves per year.

Glove manufacturers aren't the only ones impacted, with the price of tyres and rubber boots also on the rise.

Somewhat surprisingly, given Malaysia's relatively plentiful gas supplies, peninsula Malaysia has insufficient supply to meet demand, with 23% of gas used imported.

This has lead to the bizarre situation of the country building coal fired power plants to meet its energy needs, baulking at building a gas pipeline and instead relying on Indonesian coal exports. On a slightly brighter note, the coal plants are replacing a lot of existing diesel fuelled generators, and the government is promoting the upgrade of old gas turbines to new efficient models.

Cross posted from Peak Energy

Where ever I travel, Taxi drivers I find are the most

knowledgeable of nearly everyone I meet.

I suppose the biggest information I took from your excellent article and observations was that P.O. is

a global or pandemic event.

I don't know about that, most of the Hong Kong taxi drivers barely spoke English, and didn't knew critical locations in the city (like the Hong Kong island ferry).

For those who are unfamiliar with this area, Langkawi is at the border with Thailand on the Mallaca Straits side of the Malay Penninsula. It was the former Prime Minister"s home area and he made it a showcase to support a moribund area. New airport, harbor, roads, visitor center, convention center,state run resorts etc. which attract further investment.

The oil from Malaysia comes from the most distant end of the country, about 1000 miles away. These areas are both Moslem enclaves. I spent many years sailing this country and agree with Big Gav that the people are well informed and have legitimate complaints on how the oil revenue is wasted. They also seen to have forgotten that their country got all the good bits left over from the breakup of the previous state which included Singapore and most of Borneo. Sort of a lucky land grab for them. They have lucked out by fighting the IMF [ and winning ] and getting all the oil. But time is running out for them and they have the usual over population problem. It's a country with high tech enclaves and the rest is rural or jungle.

Their prognosis is poor once the oil stops getting imported and world trade slows down . Fortunately their government will be able to learn from the examples of England, Australia, US,etc.

Might be a good idea if they established a sovereign wealth fund, cut down on the sense of communal entitlement and stopped dreaming of becoming a first world country. Good advice for us also.

I reckon this I'll still be able to refuel here for the next decade, even if the price is higher. Best wishes to the people of Malaysia.

Dave on Meander

Hi. First time poster longtime lurker.

Just a couple of clarifications. There are two areas of offshore production in Malaysia. One is off the coast of the state of Terengganu, about 250-300 miles from the island of Langkawi that Big Gav visited. The other is off the north coast of Borneo, essentially the same production fields that give Brunei (an independent sovereign nation) their oil. That area is the one about 1000 miles away.

Terengganu is as Moslem as any other non-heavily urbanized state of the peninsula, although the state north of Terengganu (named Kelantan) has a state government led by a party with a conservative religious outlook, in contrast with the national (Federal) government a multi-ethnic coalition.

And neither is Sarawak state a Moslem enclave, whose state government is staunchly pro-business (to the detriment of the environment). Brunei, an independent country squeezed between Sarawak and Sabah states, however is a country with a populace that is relatively conservative but run by a pro-western Sultan.

As far as the lucky land grab, it was more a matter of political convenience between the peninsular states and the former British Borneo areas of Sarawak and Sabah, in the mid-sixties when the Brits left it to their colonies of the area how to group themselves. Peninsular Malaysia had no means of grabbing anything (Malaysia in fact had to ask the Brits and allies to help stop attacks by Indonesia in the sixties).

Rubber will remain in demand for a long time. I'm curious about the state of their military though. It seems to me like they will be a prime target somewhere down the road, probably after they stop exporting energy and their natural resources will be desired by some bigger players. With Thailand so nearby and the King's advanced age, it seems like some chaotic times may soon come. Throw in the other countries in the region with their long histories of disputes... I think many of the expats will want to leave. I basically think the area could become a powder keg.

I think in years to come, after nato defeat in asia is no secret, countries like india and china will like to take their share on south asia. China would almost certainly like to stretch it arms on korea (formerly a part of china till beyond 1900) and japan (enemy of two thousand years). India would like to sharp its teeth on bangladesh, burma, malaysia etc. Given the weak militaries and strong economies of these countries its a very likely occurance in my opinion.

I don't think the Indians or Chinese would have much more luck in south east asia than the Americans have had in Afghanistan and Iraq - it would just become a quagmire for them (assuming they would actually try such an adventure, which I doubt).

Malaysia and Indonesia are different to China or India - both by ethnicity and religion and would likely resist foreign military interference pretty vigorously.

In any case, as oil production in the region is in decline, the available "prize" is far less tempting than Iraq's oil riches - where is the payoff for a military campaign ?

As for Japan and the Koreas, all are nuclear capable - the Chinese wouldn't invade for the simple reason that nuclear powers don't invade one another. And that is the end of that.

TOD editors appreciate your support:

http://digg.com/world_news/A_Visit_To_Malaysia

http://www.reddit.com/comments/6uqn8/a_visit_to_malaysia/

Nice story Gav. What happens to half a billion people in south-east Asia is going to have a big impact on the future of 25 million people in Oz. And we get a good deal of our oil imports from regional exporters like Malaysia.

I think the Malays will be able to adjust for a while - compensating for declining oil production with gas and palm oil -> biodiesel.

There were a few letters to the editor in the papers about solar power - given the propensity for government mandated industrial development they might start to get with the program and build a few PV factories once the writing is on the wall.

Then again they could just build more coal fired power and make the place even hotter.

I probably should have included a map showing where the oil is - as noted above, it is mostly in Terengganu and offshore Sarawak.

Its worth noting the location of the Spratley Islands as well, which are believed to have oil and have been a boe of contention ebtween most countries in the region, with China and Vietnam throwing their weight around the most.

While I didn't dwell on the steady destruction of the forests of Kalimantan (Borneo), I probably could have thrown in this link to a story from Wade Davis...

http://www.context.org/ICLIB/IC29/Davis.htm

Very informative story Gav. Your taxi-driver probably told his missus. "Gee, I met this tourist today who seemed surprisingly well-informed about energy issues..."

;-)

:-)