The Scales are Balanced

Posted by Phil Hart on April 14, 2008 - 10:02am in The Oil Drum: Australia/New Zealand

Click to Enlarge

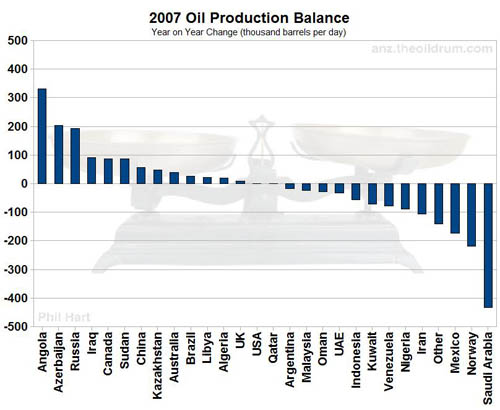

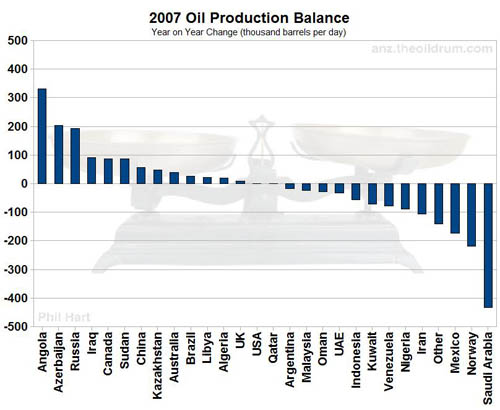

2007 Net Change: -264kb/d

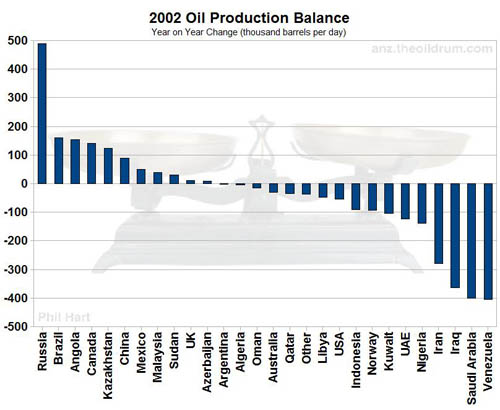

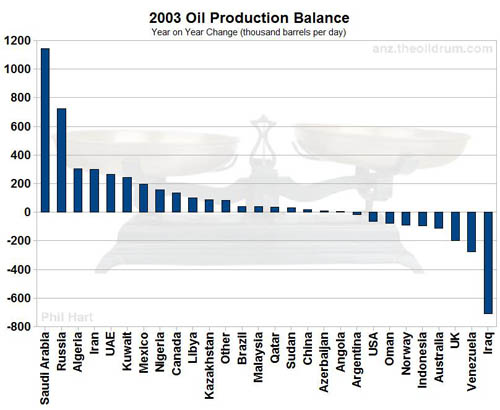

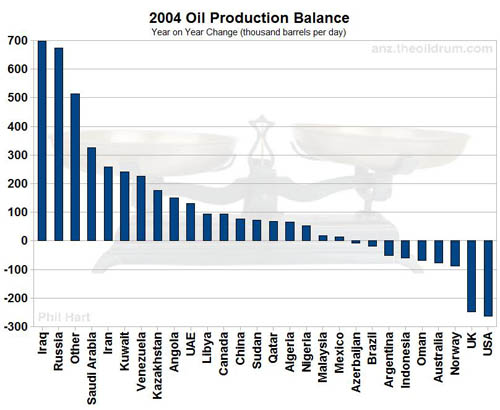

Here then is a chart-fest for all of you, showing the balance between countries who expanded their production compared to the previous year and those whose production declined. It's pretty self explanatory, but note the difference between the strong growth years around 2004 and the very slight decline experienced in the last two years when the scales have been nearly 'balanced'.

Charts are based on Energy Information Administration Crude Oil and Condensate data up to and including January 2008. The label "Other" includes Denmark, Ecuador, Columbia, Equatorial Guinea, Gabon, India, Syria, Vietnam, Yemen, Egypt and everything else not individually assessed by the EIA. The 2002-2008 charts have the same total range of 1000kb/d except for 2003 (although 2004 has a different mid-point).

Click to Enlarge

2002 Net Change: -934 kb/d

Click to Enlarge

2003 Net Change: +2,279 kb/d

Click to Enlarge

2004 Net Change: +3,065 kb/d

Click to Enlarge

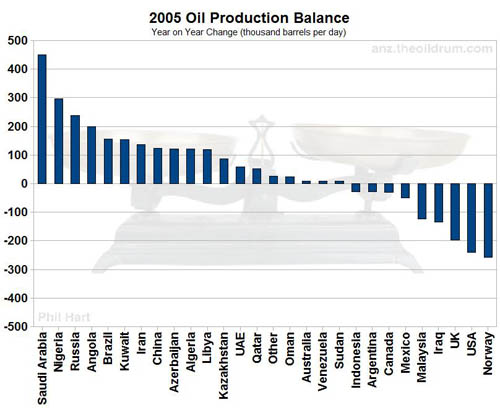

2005 Net Change: 1,294 kb/d

Click to Enlarge

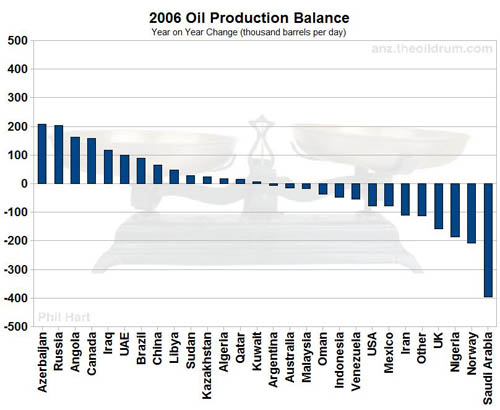

2006 Net Change: -267 kb/d

Click to Enlarge

2007 Net Change: -264 kb/d

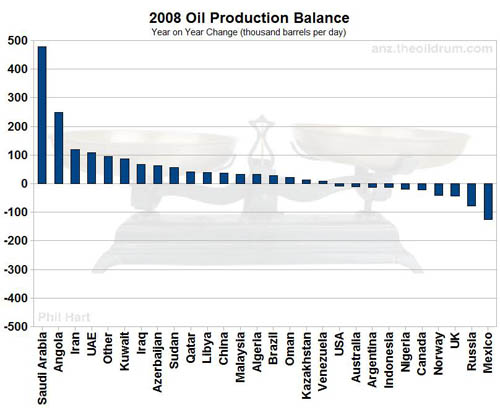

Now, with an enormous caveat that this is based on just one month of data, here is the production balance for the start of 2008 - what a difference compared to last year's average! Saudi Arabia, which was at the bottom of the class for 2007, has jumped straight to pole position starting 2008 nearly 500kb/d higher than its average for 2007. Meanwhile Russia, a top three performer in 2007, has plummetted to second last although it doesn't have much company in the 'declining' category at this early stage.

Click to Enlarge

2008 Net Change (one month average): +1,192 kb/d

To make sense of this story, we can break these countries into categories. First the category of countries who have shown generally expanding production over the last five years:

Click to Enlarge

Russia has been the star performer in this group but its growth has slowed each year with the trend now taking it to the negative side of the balance sheet. Once we lose Russia from this category, it will be that much harder for expanding countries to outweigh the declining countries. However, Russia has substantial project capacity lined up for 2008/09 so substantial declines may yet be postponed?

Qatar, Libya and Algeria also maintained their positive contributions, as I anticipated in a "Simple Oil Production Estimate for 2007" here at TOD in March last year.

Brazil disappointed in 2007, but we may finally see some of the fruit of their efforts this year so I expect to see it near the top of the table in twelve months time. In return for its incredible (and destructive) toil, Canada continues to eke out small gains. Kazakhstan and especially Azerbaijan continue to build capacity in the Caspian 'frontier'. NGL's and to a lesser extent 'Other Liquids' are strong contributors to the Total Liquids picture but not of so much interest here.

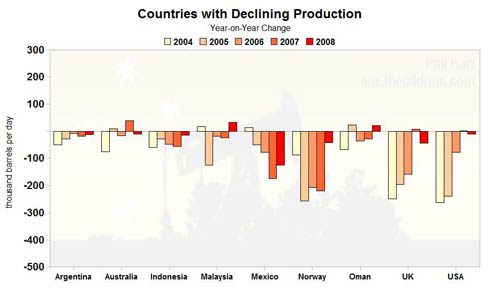

Despite the individual uncertainties, in aggregate we can be reasonably confident that this group of countries could post a significant gain again in 2008. For the other side of the story, here are the countries which have generally been declining over the last five years:

Click to Enlarge

The usual suspects Mexico, Norway and the United Kingdom are here, although the UK managed a tiny gain in 2007. The United States are almost holding their own with recent projects and may do so again in 2008. Australia also has enough new projects to hold steady for awhile. Oman, Indonesia, Malaysia and Argentina are all on a declining trend but not very significant on a global scale.

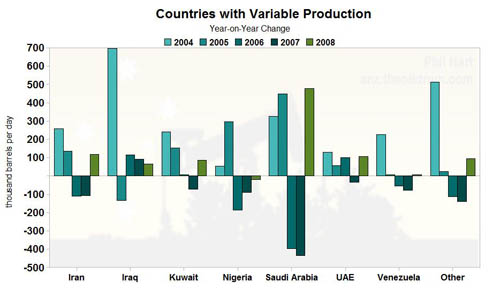

In total then, this picture of decline is less compelling than I expected. The rest of the story comes from a group of very unpredictable countries:

Click to Enlarge

Since 2005, Iraq has been almost the inverse of Nigeria - their respective volatility almost cancelling each other out. The future prospects for these two are as uncertain as ever.

Iran, Kuwait and the United Arab Emirates have a similar pattern of earlier strength followed by declines in 2006-07 with increased production over the last few months. Saudi Arabia is the real wildcard - it alone had the same impact as the previous three combined, but with a similar pattern - ostensibly all in line with their OPEC quotas.

We can then make reasonable predictions for the countries grouped in the expanding and declining categories. The uncertainty ahead remains largely around Saudi Arabia, the combination of Iran, Kuwait, UAE and the impossible to predict Iraq/Nigeria combination.

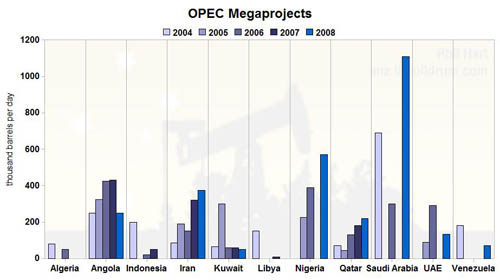

As a separate mental exercise, we can look at the Megaproject capacity for each country over the same period:

Click to Enlarge

In the chart above for OPEC countries:

- Angola's production correlates very closely with it's relentless production expansion over the last five years.

- Iran, Qatar and the UAE may have enough on their books to support their production a little longer.

- The cupboard looks bare for Algeria and Libya this year.

- Saudi Arabia is a wildcard. Khursaniyah due last year should eventually contribute this year. Rumour has it that Khurais will be delayed at least as much, which would not be at all surprising for such a large project in any country.

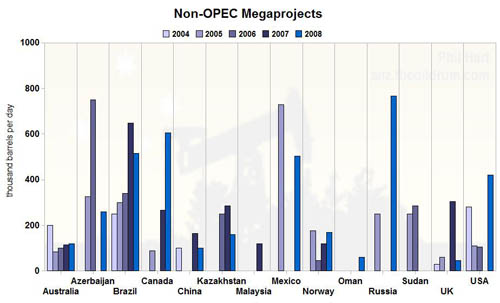

Click to Enlarge

For the Non-OPEC countries:

- While Brazil showed a solid gain in 2005, its performance in 2007 was poor compared to the massive project capacity. There have been several delays announced so perhaps we will see better things from Brazil this year?

- Russia has massive planned capacity additions for 2008 which may offset its trend into the declining category?

- Canada, Mexico and the U.S. all have big plans for 2008.

- China will not make a significant gain this year - it's days in the expanding category are also numbered.

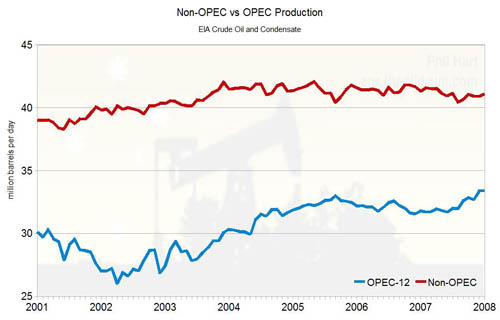

Finally, the OPEC vs Non-OPEC production picture tells a thousand words:

Click to Enlarge

As the energy agencies and other conservative commentators begin to comprehend a peak in Non-OPEC production in the next decade, it increasingly appears to be much closer than that, if not already behind us. Apart from a last megaproject gasp in 2008/09, Russia's strong growth phase is over. There are now not enough Non-OPEC producers on the positive side of the balance sheet and OPEC's strategy seems to guarantee that outcome.

If OPEC continues to assimilate countries (like Angola) with expanding production then it is a given that Non-OPEC has passed peak. Yet given the enormous production challenges Iran, Kuwait, United Arab Emirates and Saudi Arabia must be facing, you still have to be impressed that they have managed to increase production over the last few months - these are not incompetent and incapable national oil companies. I believe they had to pull out all the stops and more to achieve this feat, and so they will take any opportunity to relax if demand softens as a U.S. recession unfolds. It will not exactly be voluntarily reducing production, but they will probably call it that.

Given where we are starting 2008 and the Megaprojects due onstream, there is one plausible scenario where production this year exceeds last year's average. But whether you look at production in Nigeria, Iraq, Iran or Saudi Arabia (or demand in the U.S.) there is plenty of downside potential.

This article is available as a PDF and you can Contact the Author.

Thank you for an excellent, self explanatory and well balanced presentation.

Question is given official reserve estimates (EIA; BP Statistical Review) which producers will provide growth and which producers will decline througout 2008?

Even if the data (EIA IPM) for the last 5-6 months have shown some growth in total C+C supplies, there is a lot in the news that raises expectations that supplies will show a decline through 2008 even with new projects coming on line.

it's interesting.. 'gut feel' says 2008 production could be going down, but all the data says it's got a good chance of going up.

It will become interesting to see how the 2008 net change diagram will develop on a monthly basis throughout 2008.

Presently 2007 is 0,53 Mb/d (C+C) lower than 2005.

Great data analysis, although I think including 2008 after one data point is stretching it a little. I'd love to see the charts after, say, six months of 2008.

you're right, and if I could do it with six months of 2008 data now I would! :-)

since the data was there, it was easy to add it. it helps to show how the trend of 2007 has changed. Saudi/Iran/Kuwait/UAE all pumping a lot more than their average for last year. Can they maintain it? We'll watch the scales through the year.. I certainly expect to see them tip back towards evenly balanced as more data comes in..

Phil.

Great analysis, Phil!

As I have the forecast data already, here are a couple of more charts for you.

C&C for Jan 2008 was 74.47 mbd. I think Feb 2008 might be a little higher but could be the peak month for 2008.

click to enlarge

2009 forecast is a worry as production decreases from declining countries far exceeds production increases from increasing countries.

click to enlarge

Excellent analysis. Thanks a million. Those bar charts at the top are net, ie advances minus declines for esch country, and therefore for the world. That means that January 2008, up 1.4%, covers expected demand growth, and the big hits from the megaprojects are yet to appear. That is very bearish for oil for late 2008/early 2009 at least. SWAGs on where the price might go would be welcome. Comments everyone?? Murray

sorry i can't stick around for the discussion - it's well after pumpkin time in melbourne.

back later..

cheers

phil.

As far as the 2008 figures go,

Saudi Arabia appears to have reduced production from 9.2 to 9.0 Mbpd already. It will be interesting to see if new megaprojects reverse this again.

Russia has several reports quoted on TOD that in the short term oil production is unlikely to rise much, so I am not confident that we will see significant increases from megaprojects. We all know WestTexas is predicting sharp declines from Russia in the near future.

Russia publishes very transparent and up to date information on their crude oil production here: http://www.riatec.ru/en

They have been declining since December, down a little under 3%, with the data up to date through April 12.

Hey Phil

Has anybody made any submissions to Rudds 2020 thing?

a few ASPO folks were nominated but none got an invite :-(

a few others have worked on submissions as well i think. i have a great garnaut submission from another reader which i need to work up into a post for TOD ANZ..

RalphW:

A lot of the decline in production for Saudi Arabia had to do with with OPEC cutting quotas something like 2 MBPD since early 2007, when crude dropped below $60 per barrel and looked like it was going into the $40 range.

Also, a lot of countries have declined has been because of politics, not economics. While some people say this is an excuse for actual depletion rates, that's just not the case. Regardless, the result is the same. Violence and crippiling corruption has kept Iraq production below a potential of probably around 6 MBPD of production easy, same situation in Angola and Nigeria. Iranian and Venesualan production has if anything declined because a lack of investment, besides the fact that Hugo Chaves turned PDVSA from one of the best run oil companies in the world to a POS company that he packs full of cronies who couldn't care less about production levels. Mexico has also suffered from a lack of investment, although that is addressed to some extent.

The other huge problem around the world is rising demand due to fuel subsidies. In Iran, Venesuala, China, etc, gasoline is subsidized to the point where it's pennies per gallon. While people here scream from the tops of mountains how we subsidize oil, in reality, the government here makes more money off of oil than the oil companies (Exxon has 10% profit margins--the highest in the industry--while in places like california, taxes are $.60 per gallon). Because of that, you have for example Venesualens who almost all have gasoline generators for electricity because many don't have access to the grid and gasoline is $.12 per gallon. China has a similar problem when it comes to cars.

You give a very simplistic view a widely complex array of production problems.

First off, even without the violence in Iraq the oil may flow at rates up to 6 mbpd, but that would assume that major oil companies could work easily with the Iraq government to get a fair share of the profits. Even under best circumstances this level of 6 mbpd would not be reached for six to ten years. Don't count on anything good happening to the Iraq political situation for many years, especially when a melt down of the US economy forces the US to leave prematurely.

As far as Iran goes, they could produce more, but why should they? The investment in nuclear power is to provide electricity from a source other than oil, which they know to be their sole livelyhood. So they will continue to produce at slow rates. They are also increasing the price of gasoline, which by the way is not subsidized, but sold at a much smaller profit margin since their oil production costs are more like $8 per barrel versus NYMEX price of $110 per barrel. And for China, they too are bringing the price of gas and diesel closer to world market price.

Your comment about gas being taxed at $0.60 per gallon in California has nothing to do with production, as the oil companies make a profit from oil sold at NYMEX price, not gas station refined product price. Even if gas were taxed at $0 (which would provide no money for roads which create the demand for gas) The oil companies would not be inclined to produce any more.

Bottom line is if you want more production of oil it will cost a lot in E & P costs and take many years. I suggest you look at the work going on in the Bakken formation of the north central US, typical of many of the world's new oil production areas. Same could be said of Orinoco basin in Venezuela. The easy oil is largely gone!

Phil, imagine these same graphs, but for net exports. I drool at the thought of such graphs. These are great too though!!

Marco.

To add quickly, such net export graphs presented next to the crude price graph would really be an EUREKA moment for us I think!!

Thank you for the very good and thought provoking work. I'm almost finished reading The End of Oil. A very good book. I hope he writes a follow-up.

Iraq really is the big unknown factor in the peak oil equation. Iraq has the worlds second largest reserves,but has only drilled about two thousand wells. Compare that to the million or so in Texas.

The problem with Iraq is at some point the US will have to let the steamcooker lid pop off so the Sunni's and Shiite's can have their civil war, and that will reduce a rubble strewn landscape to dust, that is until they eventually rebuild under new leadership and start pumping lots of oil and drilling new wells. The timing of all that will depend on how long we stay there. The sooner we leave the sooner all that can happen.

But this approach will simply create another Iran and probably Iran/Iraq war II. Given the situation the chances of a Iraqi civil war not expanding into a regional war is pretty slim.

I understand your sentiment but the US is now damned if it does and damned if it does not with Iraq.

I understand your sentiment but the US is now damned if it does and damned if it does not with Iraq.

This is why we call the whole sad situation a quagmire.

My viewpoint is pretty grim. The US has to remain so the Iraqi's can have a proper civil war and kill each other without outside interference. Note that in history fomenting civil war was a common tactic used for empire building.

Its been a long time since this was last practiced but its a time honored approach. As long as Iraqi's are busy killing Iraqi's they are helping the US. The job of the US is to simply ensure a level killing field.

level killing field

Ooh, delicious -- that's a keeper.

This "proper civil war" will not conclude while there are "empire building" troops present. As long as the US has forces in Iraq they will only allow a victor whom the US finds acceptable. But such a leader will always be seen as a lackey by his own countrymen. This is not the type of leader who can bring his country forward into the stable condition needed to fully exploit these oil reserves.

We can pull out voluntarily, or stay until we are defeated. That could be a very long time.

Sciaroni, I agree 100%. If you go back to my first post that initiated this thread, you'll see we are on the same page. Essentially we stuck our finger in a hornets nest and until we pull it out, Iraq will not be able to find a new regime to follow.

I think what counts is not how much is produced but how much gets out onto the open market (for the importing countries at least!)

Nick.

Thanks for the nice graphs! Another post that looks at somewhat the same kind of thing is Matt Mushalik in this post.

OPEC wouldn't look nearly as good without Angola. If Angola's production is really flat going forward, as this article suggests, OPEC is not likely to do nearly as well in 2008 and 2009 as the graph of recent past production would suggest.

Based on 2007 annual data, the largest six countries / areas show the following production in (000) barrels per day.

Russia__ 9,437

Saudi Arabia__ 8,722

United States__ 5,103

North Sea__ 4,114

Iran__ 3,922

China__ 3,729

At this point, all of these countries/areas are showing signs of possibly being past peak. Some of them may be too soon to call, or may be past peak for other than geological reasons. Even so, this is scary.

Hi Gail, What's also scary is how huge those daily numbers are, meaning the World has developed to the point of requiring huge amounts of oil and other fossil fuels to the tune of 200 mbd. So on the one hand its scary oil has peaked/plateued, but even scarier is to wonder what the trip back down from this pinnacle of civilization will portend.

A strange thing happens when you look for oil. You find it.

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=ay.nnQo9lXXM

RC

And 10-20 years from now when this field is online ?

And it's a fantasy figure anyway

http://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=ay.nnQo9lXXM

It does not matter if its real or fantasy. Brazil would not export it in 10-20 years anyway. The Brazil people won't allow it. At some point after peak I think you will see oil become a national treasure to be used in the internal economy.

The US could invade Brazil if they withold their oil from international markets. The Carter doctrine enshrines the right of the US to guarantee its access to global oil.

Of course no one else has signed up to the Carter doctrine, but that is what the US is doing; and continues to do. I am sure the US could find some pretext to attack Brazil, or they could just come right out and say it: "Not guaranteeing US access to oil, or allowing it to be used domestically, or especially by allowing it to be used by anybody else (China?) is an act of war".

The Carter Doctrine applies to the Persian Gulf, not Brazil. Now let me hear all you Brazilians say "whew!"

Brazil has a bigger and better uranium centrifuge project that Iran. You don't hear about it because we aren't trying to push Brazil around. We aren't trying to push Brazil around because Brazil has a larger percentage of iron ore exports than Iran has of crude oil exports. They have us by the short and curlies and don't they know it.

"It does not matter if its real or fantasy. Brazil would not export it in 10-20 years anyway. The Brazil people won't allow it. At some point after peak I think you will see oil become a national treasure to be used in the internal economy."

Great! If the Brazilian economy has grown to the point that they can consume huge amounts of oil, then we must assume the world economy is doing pretty well also.

But to a more interesting point: It seems the Saudi's are on schedule to finding out who has oil to deliver. In 10 or 20 years the detractor may say, but 10 to 20 years is TOMORROW for the purposes of those who have to plan in terms of billions of dollars in investment and years of planning. They can't hope for return on that kind of investment in less than a decade ahead, more likely closer to two.

The Brazilians are in the same shape. They must lay the groundwork now. Some of us are old enough to remember when the North Sea actually begain to deliver oil in quantity. We also remember the "experts" who laughed it off as a joke, that it would never deliver in volume at realistic prices.

The Saudi's made the same mistake, and no one heard of OPEC for 20 years thereafter. This time, the Saudi's are not making the same errors. They remember being marginalized all too well. They are flushing out the possible competitors. And while some may believe that nations in need of cash will sit on oil reserves as a "national treasure" oil under the sea cannot be seen and admired by tourists, it does not smell good and it earns NOTHING sitting in the ground or under the sea. Only the Saudi King talks of "saving oil for the children". Of course, the Saudi King can afford to talk in such idiotic terms. The rest of us live in the real world.

RC

30 Bbp OIP in the region 50% recovery is 15 GB's this is a bit larger than Purhdhoe Bay but not by much cut recovery to 40% and its the same size. And its a hell of a lot harder to get out. Production rates probably less than 2mbpd at peak.

Now just consider say 1% growth of the Brazilian economy over the next 20 years and tell me how much oil they will export ?

About the only thing that might moderate peak is two Ghawars found on land or shallow water.

Also, if Brazil decides to export it won't be to the USA in any event. Just today, both Obama and Hillary are calling for China to strengthen the Yuan. The Yuan is strengthening like gangbusters, now at 6.99, but the pace is evidently not fast enough. USA oil consumption will decline rather steeply as the public will not be able to compete while anchored to a plummetting currency.

I'd like to just say kudo's to Brazil its a country that should have been and may well become a super power. Maybe this will give them the economic edge they need to transform themselves if they spend it wisely.

"...a bit larger than Prudhoe Bay but not by much cut recovery to 40% and its the same size. And its a hell of a lot harder to get out. Production rates probably less than 2mbpd at peak."

memmel's point is well taken on the "harder to get out". It is oil, but it will never be "cheap" oil in the true sense. As for flow rates, that is still a guess, but the truth is that world consumption per day is much higher than it was in the 1980's. The demand dwarfs any but the largest fields.

RC

It's 1:00 am in New York City, the news from Russia has joined the news from Saudia Arabia, Tapis is $4 over 3 yergins at $118, Minas is the second to move over 3 yergins and traders are debating if today will be WTI's turn.

Is the Oil Drum press office ready to announce 3 yergin day in the USA? If it's a three dollar day, it's a three yergin day!!

Really very nice presentation and informative. I would be particularly interested in how Saudi Arabia was able to increase production of late - and is it sustainable for a year or more?

May I also take the liberty of digressing just a bit from the subject to make a request? I am interested in getting hold of current figures on Energy Content and EROI of some of the top alternative energy sources, including various grades of oil, coal, solar, algae, wind, tidal, etc.

Do there exist any up-to-date numbers on these which take into account current technological developments?

Apologies for the intrusion.

Brazil's Petrobras denies giant oil field discovery

http://english.people.com.cn/90001/90778/90858/90863/6393123.html

Ivanhoe has presented data to indicate that peak production in Russia (former USSR) was more than 20 years ago.

http://hubbert.mines.edu/news/Ivanhoe_98-3.pdf

Nice simple analysis Phil. I think the most significant chart is the last one showing flat to slowly falling non-OPEC production since 2003. Also the 2008 YTD chart is probably a bit misleading with swing producer Saudi swinging.

Also fascinating to see how quickly the balance of power can shift.

It will be interesting to see how emergent producer nations deal

with the pressures of being an oil producer in an ever more

aggressive commercial climate.

Re. The Brazil story:

Nice article in today's Guardian online (UK)

http://www.guardian.co.uk/world/2008/apr/15/brazil.oil

Quote:

Lima told an industry conference that Petrobras, the national oil company partnered by BG,

"may have discovered a huge petroleum field that could contain reserves as large as 33bn barrels,

amounting to the world's third largest reservoir."

Quote:

"But industry analysts said it was possible Lima was adding together the reserves of nearby fields in the wider Carioca area off Rio Janeiro."

Quote:

"Matthew Shaw, the Latin American energy analyst with Edinburgh-based oil consultant Wood Mackenzie, said the 33bn-barrel claim was not credible. "This is an unfortunate slip of the tongue by a senior

member of the NPA," he said. "It is likely to be a fairly modest discovery with a few hundred million barrels in place."

Quote:

"While the potential of the latest find in Brazil could add significant supplies to a global oil

market that has seen prices reach record levels on the basis that supplies are very tight,

it would take the best part of a decade before Carioca is ready for production."

-----------------------------------------

So I got out my calculator, thought about Alber Bartlett - divided 33 billion by a round up of

83 million barrels of oil used daily ... and got 397 days of global suppliy at TODAYS (roughly)

usage.

Then I read the rest of the article:

---------------------------------------

Quote:

"While the potential of the latest find in Brazil could add significant supplies to a global

oil market that has seen prices reach record levels on the basis that supplies are very tight,

it would take the best part of a decade before Carioca is ready for production."

Ah well ... never mind.

And you can find out more about Carioca here:

http://europe.theoildrum.com/node/3853